Filters

What lesson can we learn from the fall of SVB?

Why did a 40-year-old SVB fail in 48 hrs?

Now macro economist have shared the economic details on why the bank failed.

But we would like to draw attention to a more fundamental ethos - the need to focus on efficient growth.

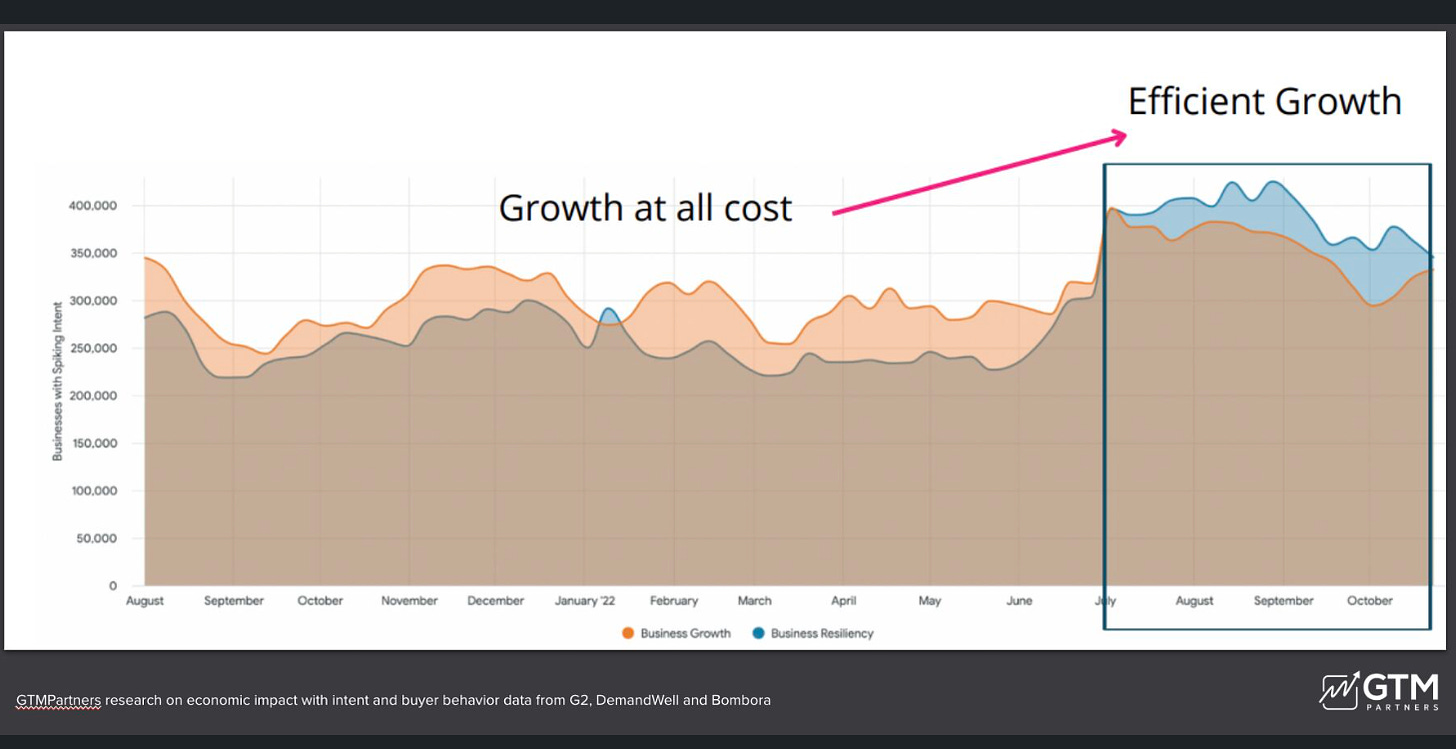

Last October, we shared an economic impact study.

The study focused on companies and industries that have a "growth at all cost" model and we predicted two things:

Either they will fail or will have to completely change their business model to "efficient growth"

What followed has been layoffs and failure but it's not all over.

What does efficient growth look like for a company?

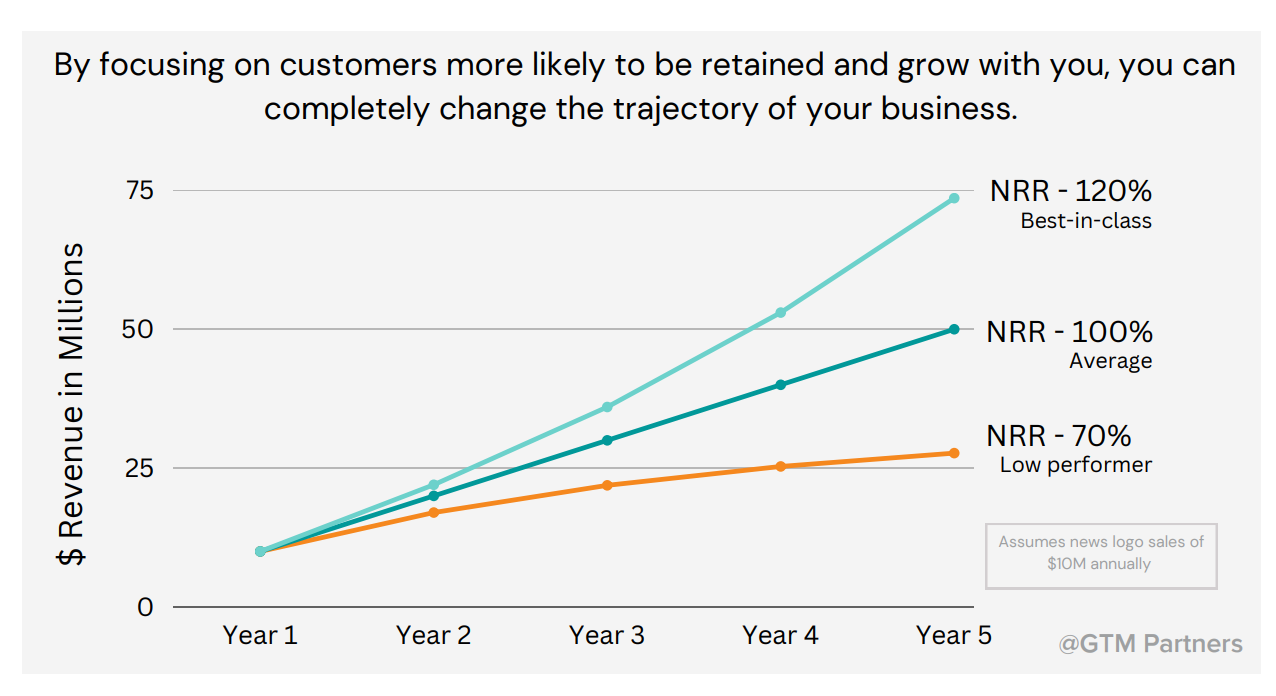

Take a look at this chart.

Here are 3 key takeaways:

NRR is becoming the key metric for many VC's, Boards, and CEO's

NRR requires a solid foundation of Gross Revenue Retention (GRR)

NRR = GRR + Expansion (selling more to happy customers)

Sure, it’s not as simple as all that, but a mind shift towards efficient growth certainly needs to happen.

Here’s the link to 3 additional resources to dig deeper and be part of the solution: