Filters

Case study: how audience-driven products built a unicorn

A little soul searching to kick us off today:

Are all of your products selling like you expect them to?

Do most of your mature customers use more than 50% of your offering (products, features, functions)?

Do you have a clear understanding of which of your products suit specific segments in your total relevant market (TRM)?

Do you have a clear understanding of which features are a competitive advantage and which are liked but not unique?

Do you have a strong understanding of which features are never used and why?

If you answered no to even one of these questions, today’s GTMonday research note is for you!

Storytime!

Gather round to hear the tale of a little company you may have heard of called Hubspot.

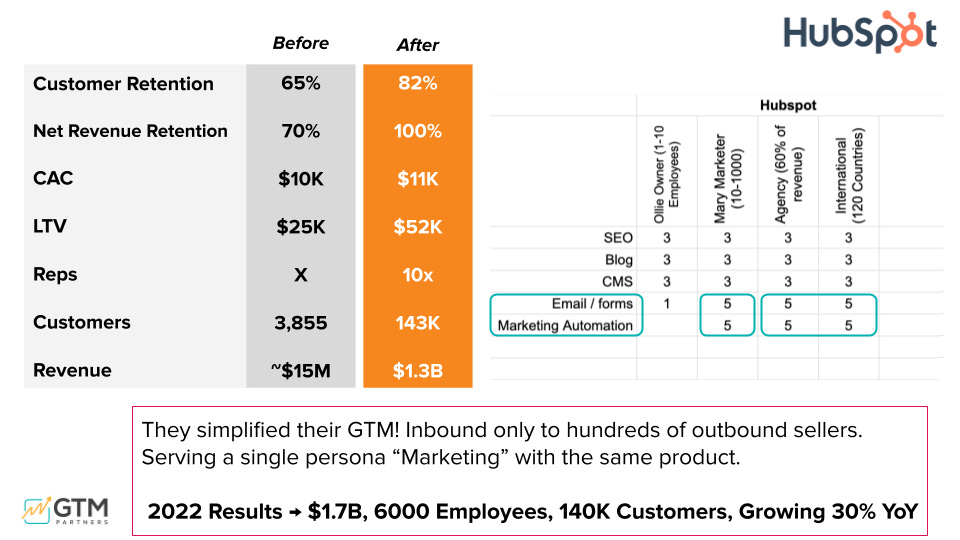

Founded in 2006 by 2010, they were already at $15.6M in revenue. Their customer retention was low (65%), and their NRR was only 70%.

But by 2021, they were a $1.3B company with 82% retention and 100% NRR!

(Today they’re over $2B in revenue).

What did they do between 2010 and today to achieve such meteoric growth?

Well, they did a lot of things, including new products and acquisitions.

But we would argue their most strategic play was early on, when they doubled down on the products that appealed to their highest-valued target customers. They added more products and featured that those customers LOVED. Then they started to expand.

Customer-centric product innovation is the secret sauce that has driven Hubspot’s expansion and acquisition strategy.

A $1B Decision

When Hubspot was getting started, they famously had two personas:

Ollie Owner - these are folks who ran an SMB business. Think dentists, gyms, autobody shops, pizza parlors. This was Hubspot’s early bread and butter.

Mary Marketer - marketers at companies between roughly 10-1000 people who were running inbound marketing.

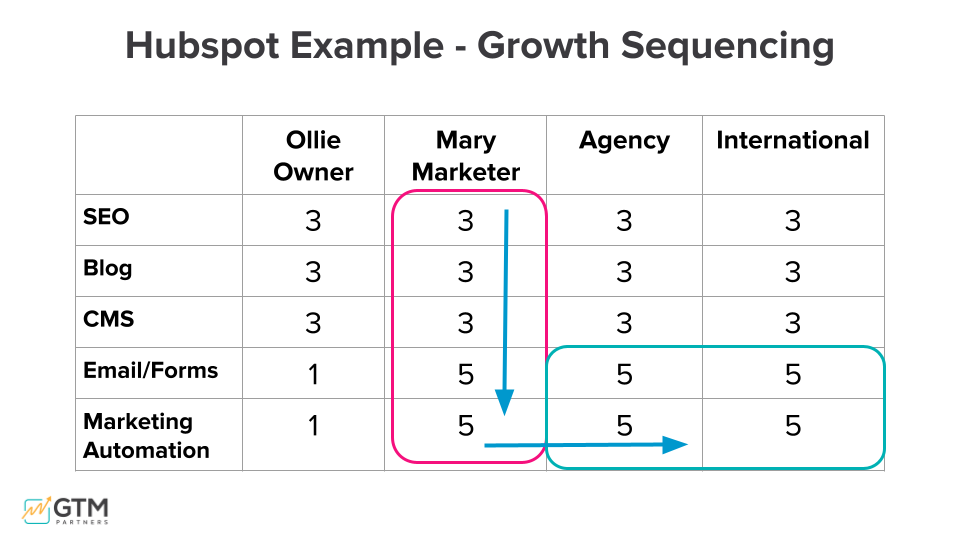

Although Hubspot didn’t use our Market Investment Map in 2010 (it didn’t exist), we’ve mapped their decision point to our scoring system

Hubspot’s early products appealed equally to both personas.

Ollie Owner and Mary Marketer both really liked and used the content Hubspot released, the blogging capability, SEO, and the CMS that allowed them to quickly make landing pages.

But the truth is that if a lower-cost or better product came along, they would have quickly switched.

These two personas liked the early products, but they didn’t LOVE them (score of 3; see table below).

A short interlude on how we score products and/or features:

5 = Customers love it and will renew.

3 = Customers are using it, but aren’t sure it’s worth it and you don’t have a competitive advantage.

1 = Customers do not use it or see value in it.

Then Hubspot introduced forms that integrated with CRM systems.

Mary Marketer’s mind was blown.

Suddenly, she didn’t have to do everything manually. Her leads just showed up in Salesforce like magic.

She rated this product 5 out of 5 . . . suddenly she can’t imagine her life without it.

Ollie Owner didn’t care much about forms and didn’t use them. That’s a score of 1 from Ollie.

So now, Hubspot has a decision to make. Do they try to go back and assess what other products and features would be exciting to Ollie Owner?

Do they try to Make Ollie Owner fall in love with Forms?

Or do they double down on Mary Marketer and build more and more products and features for her?

Their $1B decision was to lean into Mary Marketer because they had identified a product she couldn’t live without and they hadn’t found that fit with Ollie yet. No 5’s for Ollie could indicate he wasn’t the future of Hubspot.

That key decision spurred the addition of marketing automation, which again, Mary Marketer loved. The introduction of a MAP suggested vertical expansion: a new audience (agencies) and international markets.

All these audiences LOVED email, forms, and marketing automation. 5’s across the board.

Meanwhile, the company known for inbound started to do outbound! They hired hundreds of sellers, because your target audience and products should be always be aligned with your GTM motions as well.

The Market Investment Map

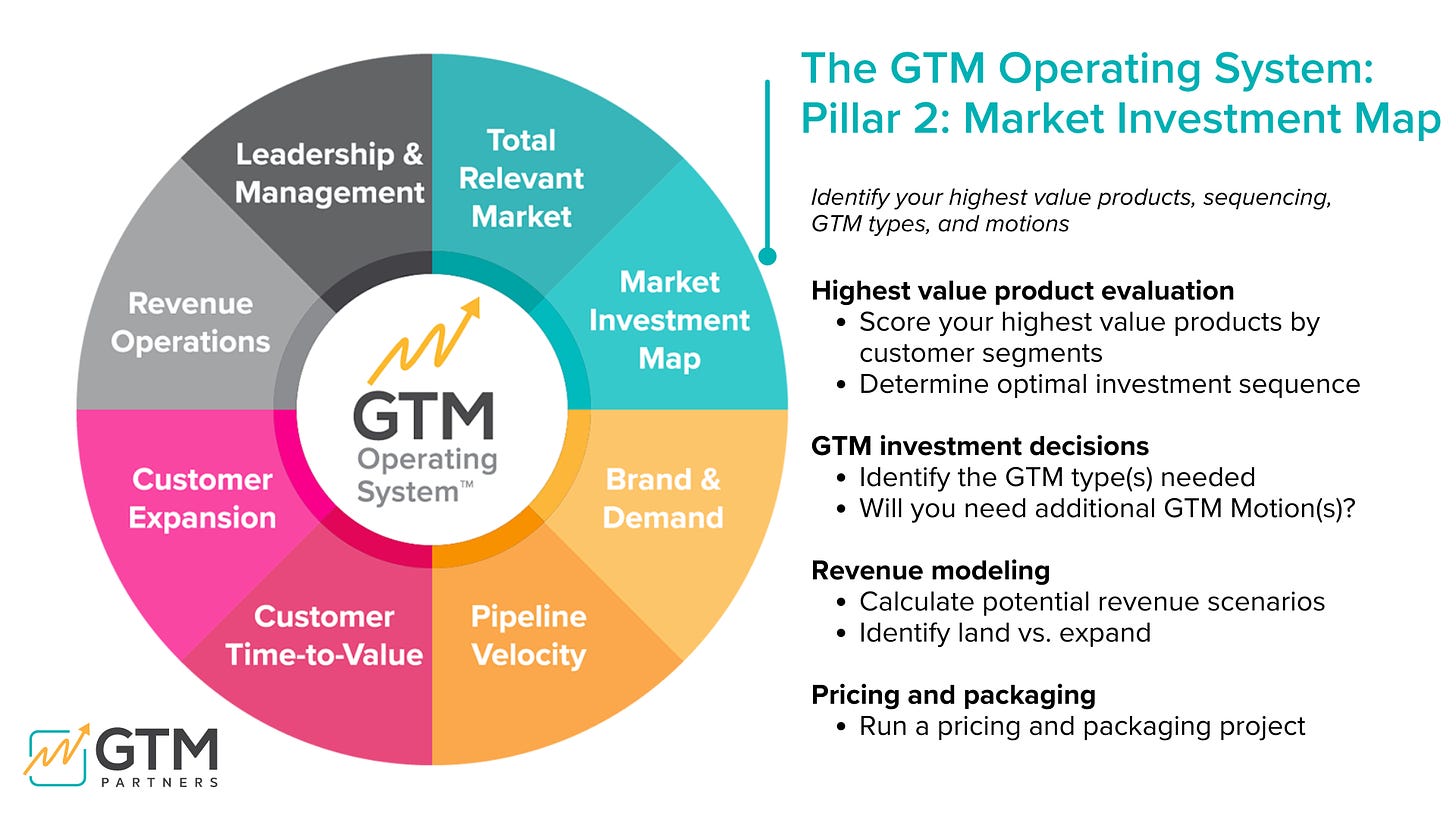

Which brings us to the second pillar in our GTM Operating System: the Market Investment Map.

The goal of working through this pillar is to gain clarity:

What are the highest value segments and products that will get us to our revenue goals?

Which product and segments can be sold the same way, to the same buyer, for the same outcome?

How many distinct GTMs can we plan, fund, and operate successfully?

This work should not happen in isolation . . . the product team can’t do it alone. This discussion should include the entire GTM team, including marketing, sales, and customer success in addition to product.

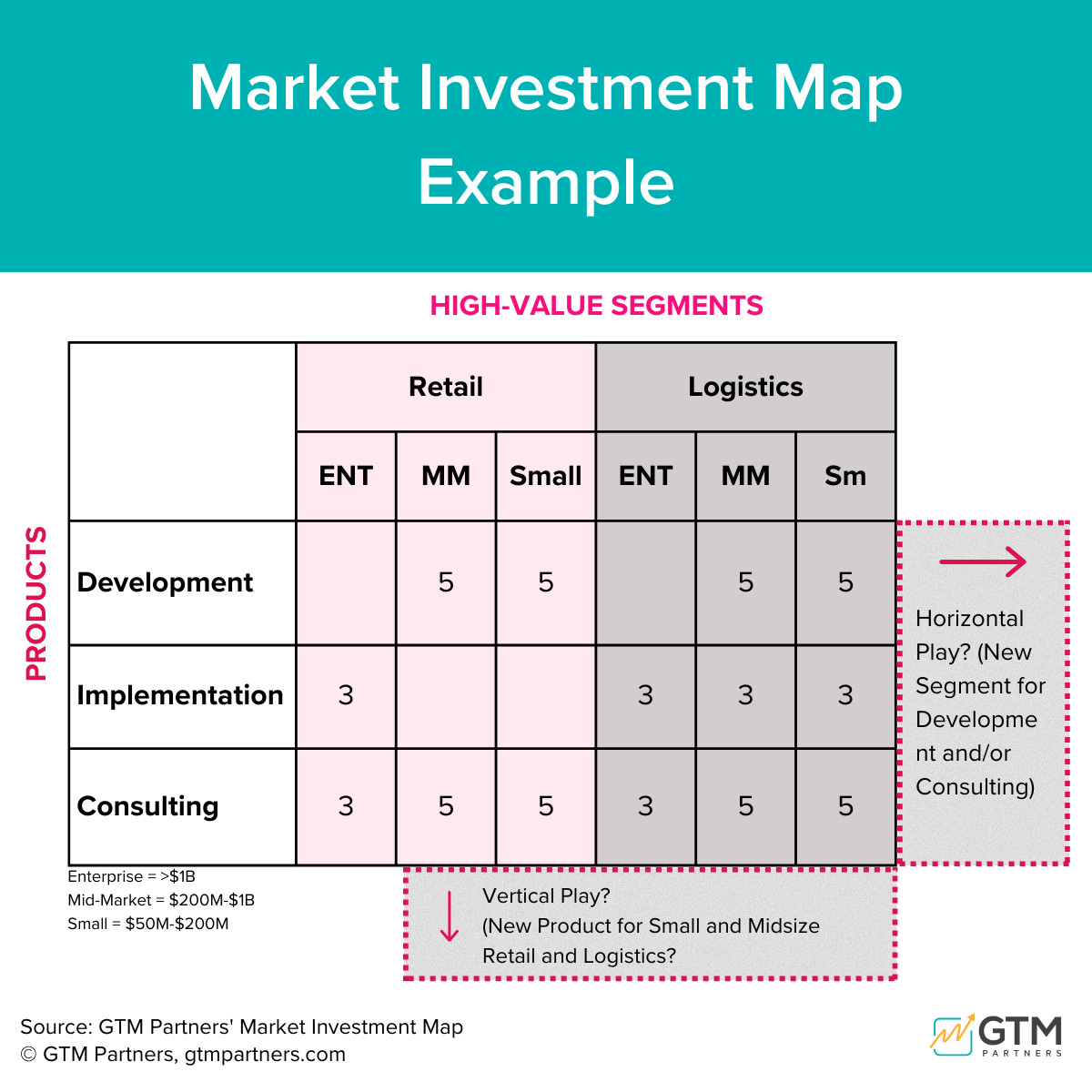

Below is an example of a simplified and anonymized Market Investment Map we made for a company that sells three services (custom product development, implementation, and consulting) to two segments (retail and logistics).

There were some on the team that wanted to invest in implementation services because it seemed like such a ripe opportunity.

The temptation is always to ask how we can turn our 3’s into 5’s with new features, functions, or campaigns. We’ve invested so much in implementation services and no one loves it! Let’s make them love it!

But what if we capitalized on our strengths and invested either horizontally (bring our development and consulting to a new segment) or vertically (create new products for small and midsize retail and logistics companies)?

Alternately, we could choose not to expand for now, but lean in to fully saturating the small and midsize retail and logistics market with new product development and consulting.

We should seriously consider easing up on our enterprise efforts. They aren’t sticking.

In order to decide what to do next, we need to dig in deeper to understand how much revenue each box contributes and what GTM motions the company plans to execute.

But that is for another day!

Need help building a Market Investment Map for your company? Let’s talk!

Webinar: GTM & AI

Top-performing sales and marketing teams are using tech and AI to not just do more with less, but to do more with what they already have, making decisions with greater intelligence, targeting audiences with better precision, creating content at faster speeds and automating processes for optimal scale.

Join GTM Partners and On24 for “GTM + AI” where you’ll learn how you can add AI into your marketing mix and innovate within proven B2B best practices for producing pipeline and revenue today —targeted advertising, content syndication and localization, outbound prospecting, direct mail and webinars and virtual events.

Join us in Austin or Salt Lake City!

We have road shows coming up in both Austin and Salt Lake City. These events are small, free, and by-invitation-only for director level and up GTM professionals. Let us know if you’d like to be considered.

Happy March! We’re getting three extra minutes of light every single day this month, leading up to March 21 when we have equal amounts of dark and light.

Wishing you energy and success!

Love,

the GTM Partners Team