Filters

81% of companies say sales velocity has slowed in 2023

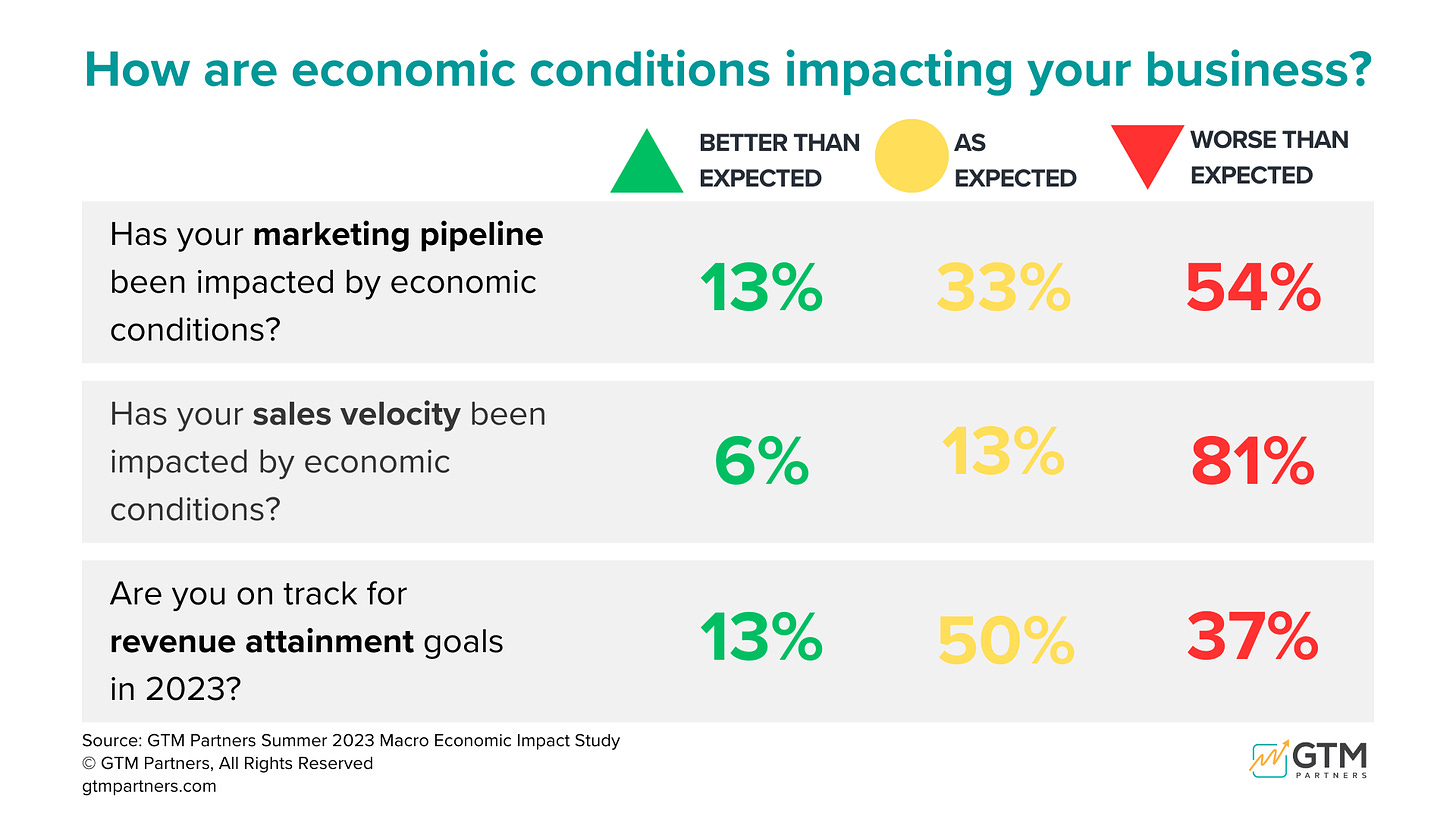

There’s good news and bad news.

The good news: 50% of companies we surveyed are hitting their revenue goals for the year.

The bad news:

54% are missing on marketing pipeline

81% say sales velocity has slowed

37% are missing revenue goals (and based on conversations we’re having these are likely to be vastly adjusted down in the first place).

50% of companies are hitting pipeline goals; 50% are not

Compared to 6 months ago, we are still seeing almost 50% of companies are hitting their pipeline targets, while the other half continue to miss their goals.

Despite many companies having adjusted their pipeline goals down since fall of last year, we are continuing to see a 50% miss in pipeline creation.

Companies who made cuts to marketing budgets need to adjust their expectations accordingly to avoid issues in revenue predictability.

As always pipeline is the canary in a coal mine for revenue growth, signaling that recovery remains slow for more than half of businesses.

81% of companies are experiencing slower sales velocity

Compared to 6 months ago, sales velocity challenges are getting worse.

Previous data on sales cycles has essentially been corrupted by the economic conditions. Historical sales cycle lengths from 12 months ago are no longer usable for planning purposes.

Resetting to the new sales cycle length as well as reviewing ICP details for your most current cohort of sales is needed to understand where your buyers are.

Segmenting your sales pipeline to find more expedient segments and leaning in on the right buyers to meet your goals is even more critical than it has ever been.

Revenue attainment is stabilizing

Compared to 6 months ago, revenue attainment seems to be stabilizing.

Small Businesses report significant improvements in their ability to meet their expectations.

Mid-market has also improved slightly in meeting expectations, but also gave back points on over performing.

Enterprise is starting to feel more attainment challenges as compared to 6 months ago.

Assuming revenue attainment goals were reset for 2023, most organizations are still experiencing a larger than desirable gap in hitting their attainment which will likely continue to impact their spending in 2023. They will be finding ways of making up for losses in cost cutting and efficiency gains.

We created this report in conjunction with our data partners Bombora and G2.

Watch Jeff Marcoux, CMO at Bombora run through data:

Lessons and Takeaways

Here are our major takeaways from this important research:

Make generative AI a part of your efficient growth strategy

Reimagine your sales & CS motion; the old system was broken and is not coming back

Grow through your best customers and find more of them (TRM)

Ensure you have a clear ROI story to retain existing customers

Reinvest in building brand and demand to get pipeline back on track

A GTM dashboard is imperative to align and activate teams

NRR is your single most important metric to focus on right now

This report has seven sections, and we will be sharing findings over the next few weeks over various editions of GTMonday, so make sure you are subscribed to this newsletter!

Last thing before we go, if you missed our summit last week on how generative AI will inform GTM functions, it was incredible. All recordings available for your perusal!

Hope the dog days of summer are treating you well and you are staying cool.

Love,

The GTM Partners Team