Filters

5 stats to share about GTM economic conditions that will help your next planning cycle

Depending on the size and stage of your company, you might be spending the month of September planning 2024, Q4 of 2023, or maybe you’re just focused on what you’re doing in September.

Whatever situation you’re in, it can be helpful to provide some broader context about WHY you’re proposing certain strategies, motions, campaigns, and themes.

As analysts, we are carefully watching the way the economy impacts GTM planning and functions. We recently released the Summer 2023 edition of the Go-to-Market Economic Impact Study.

We’re hearing from customers about the ways they are using our data in their own planning, both to provide context to CEO’s, CFO’s, and Boards, or to spur their own thinking.

So today, we’re going to share some ideas for how you can use market data in your future planning.

We’ve made this data available to you as read-only Google slides (over the objections of certain people who want us to give you a PDF for brand fidelity purposes) so that you can copy slides and use them yourself in your own presentations. So please use them. It’s all part of our mission to democratize data and redefine the role of a analyst firm.

1. If you’re struggling, you’re not alone

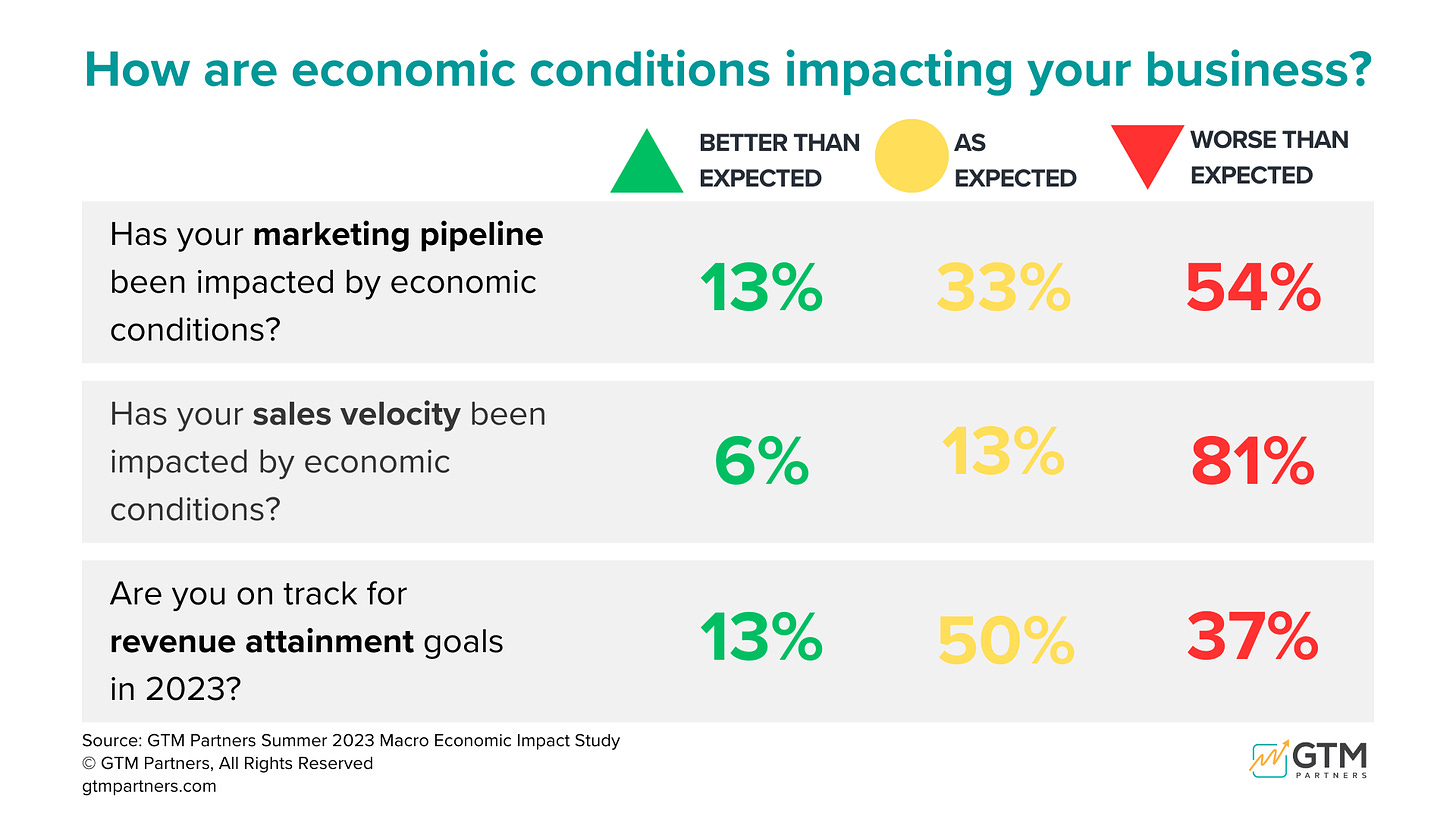

Our research shows that:

81% of companies in our survey say sales velocity has slowed this year

54% are missing on marketing pipeline

37% are missing revenue goals (and based on conversations we’re having, these are likely to be vastly adjusted down in the first place)

How should you incorporate this data into your planning?

There are two ways to include these findings in your planning if you are a company that hasn’t had the best year:

Don’t get defensive, but show your CFO, CEO, or board that your company is hardly alone. Show these stats at the front of your presentation, and then pivot to how you are going to overcome market challenges and deliver NRR in 2024.

Make the connection between decreased spending and/or reductions in force and decreased performance. We are hearing almost daily from GTM leaders who have lost have their team and 30% of their budget and who are expected to deliver the same results. Showing third-party, analyst-validated research on the direct correlation between reduced budgets and reduced performance could help.

2. Plenty of companies are still on track and investing in growth.

50% of companies we surveyed are hitting their revenue goals for the year. We suspect these may be adjusted revenue goals, but this is a solid number considering the economic conditions.

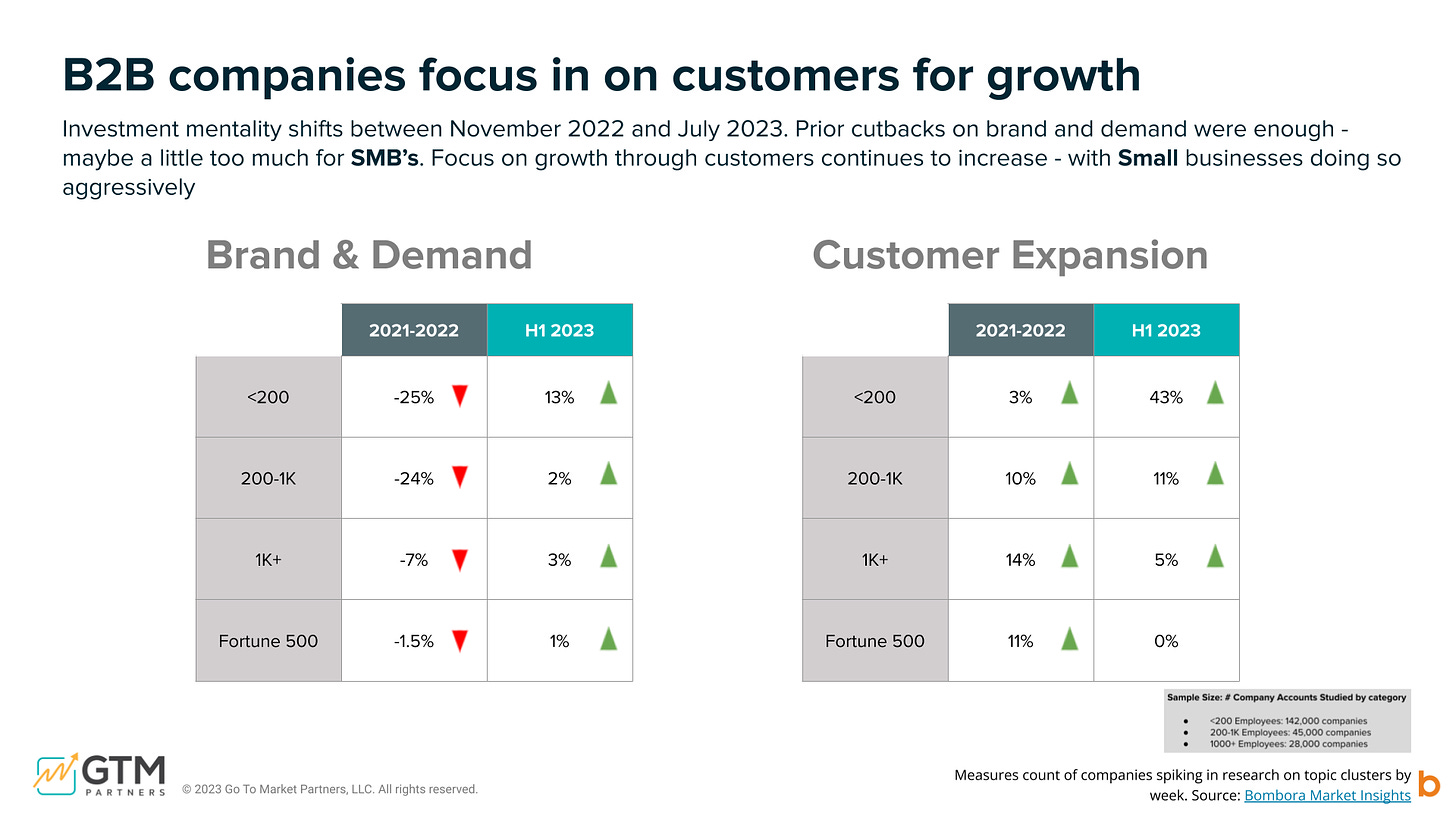

What’s more? Companies are starting to invest in brand, demand, and customer expansion again. Companies of all sizes decreased focus on brand and demand from 2021-2022, and all are increasing spending in 2023 (especially smaller companies).

Small companies are also increasing focus on customer expansion, while larger companies are still increasing, but at a slower rate.

How should you incorporate this data into your planning?

If you are a leader whose team is NOT hitting revenue goals, show them the data showing half of companies are, and dig into why you aren’t. If you’ve recently cut budgets or done a layoff, be open to hearing and believing that those are contributing factors.

Still, it is possible to thrive in this economy; the data shows it. It’s your job as a leader to guide your team to better performance.

And if you’re not investing in brand, demand, and customer expansion, you’ll be left behind. Because others are.

3. Companies are getting used to the new normal.

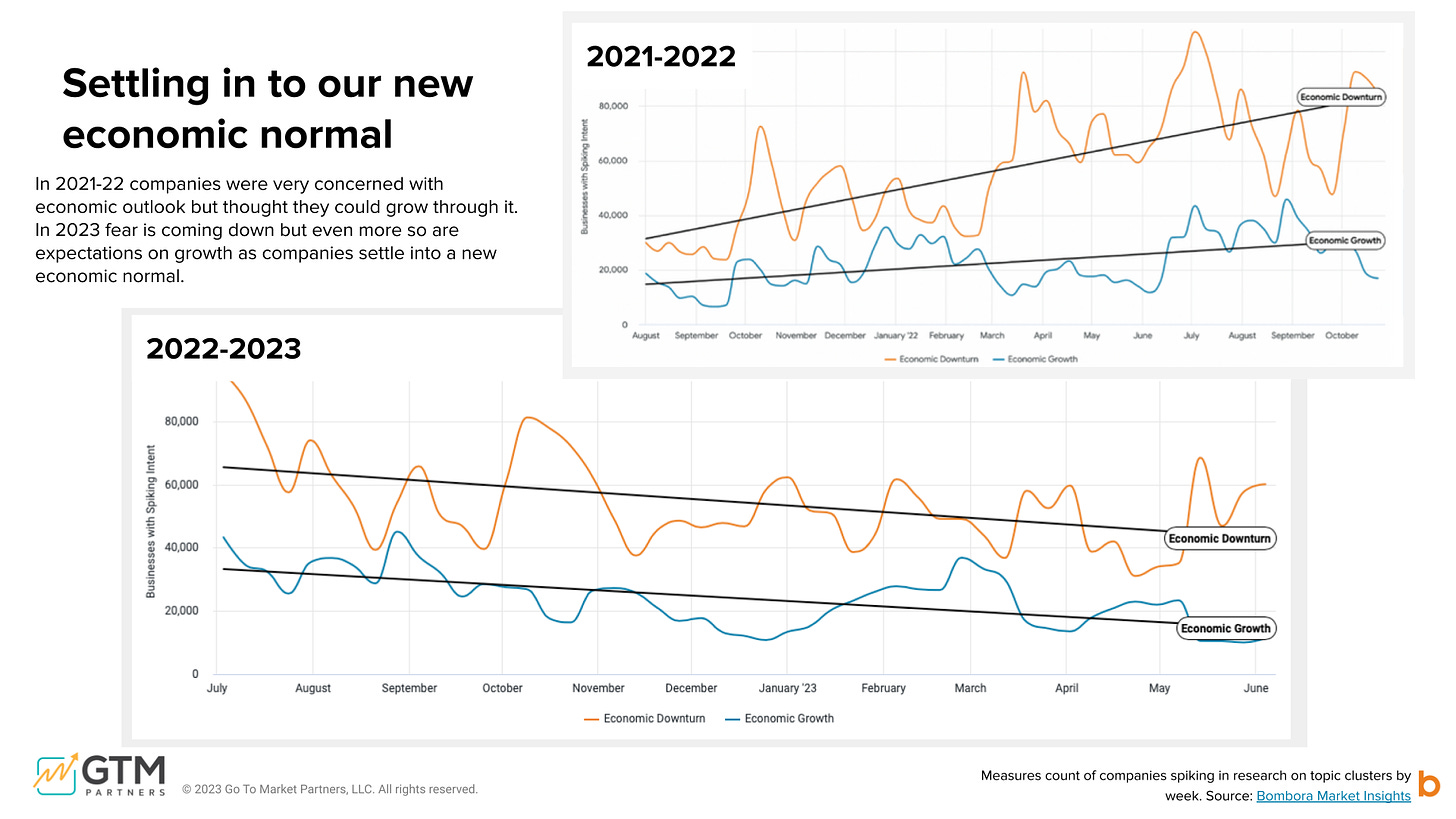

We looked at Bombora data (billions of market signals we are lucky to get access to) to compare people's research and intense focus on downturn versus growth.

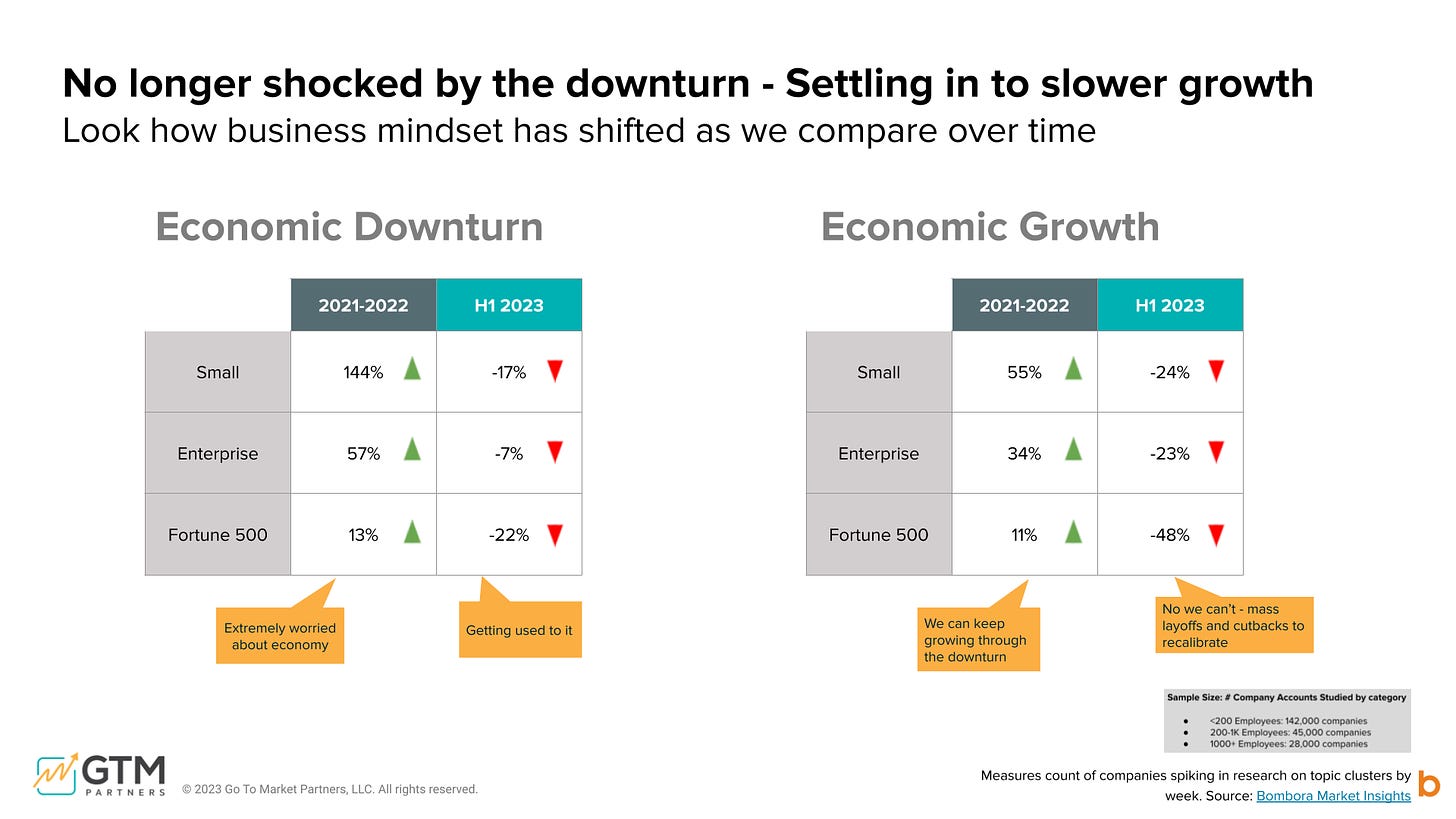

Based on Bombora trend data, from 2021-2022, companies were really worried about the economy but convinced they could weather the storm.

In 2023, companies seem less worried about massive failure, but also less bullish about expectations of growth. Everyone is settling into a new normal.

As Bombora CMO Jeff Marcoux said in our webinar about the data, “there’s some concern that downturn is here to stay. Leaders are starting to think growth is going to be quite limited, so we need to stabilize. This kind of thinking likely led to the layoffs and cuts and things like that happened earlier this year. I’m starting to see brands hibernating to some extent. We all want rapid, efficient growth, but it may not be available right now.”

How should you incorporate this data into your planning?

Depending on the strategy you’re suggesting, you can use this data in at least two ways.

If you’re laying low and proposing slightly less exciting growth and NRR targets, show your CFO/CEO/board you’re not alone and that it is a reasonable and prudent strategy given economic conditions.

If you’re bullish, show them that there is a huge opportunity to invest, charge ahead, and capture share of mind and wallet while other companies are playing it safe.

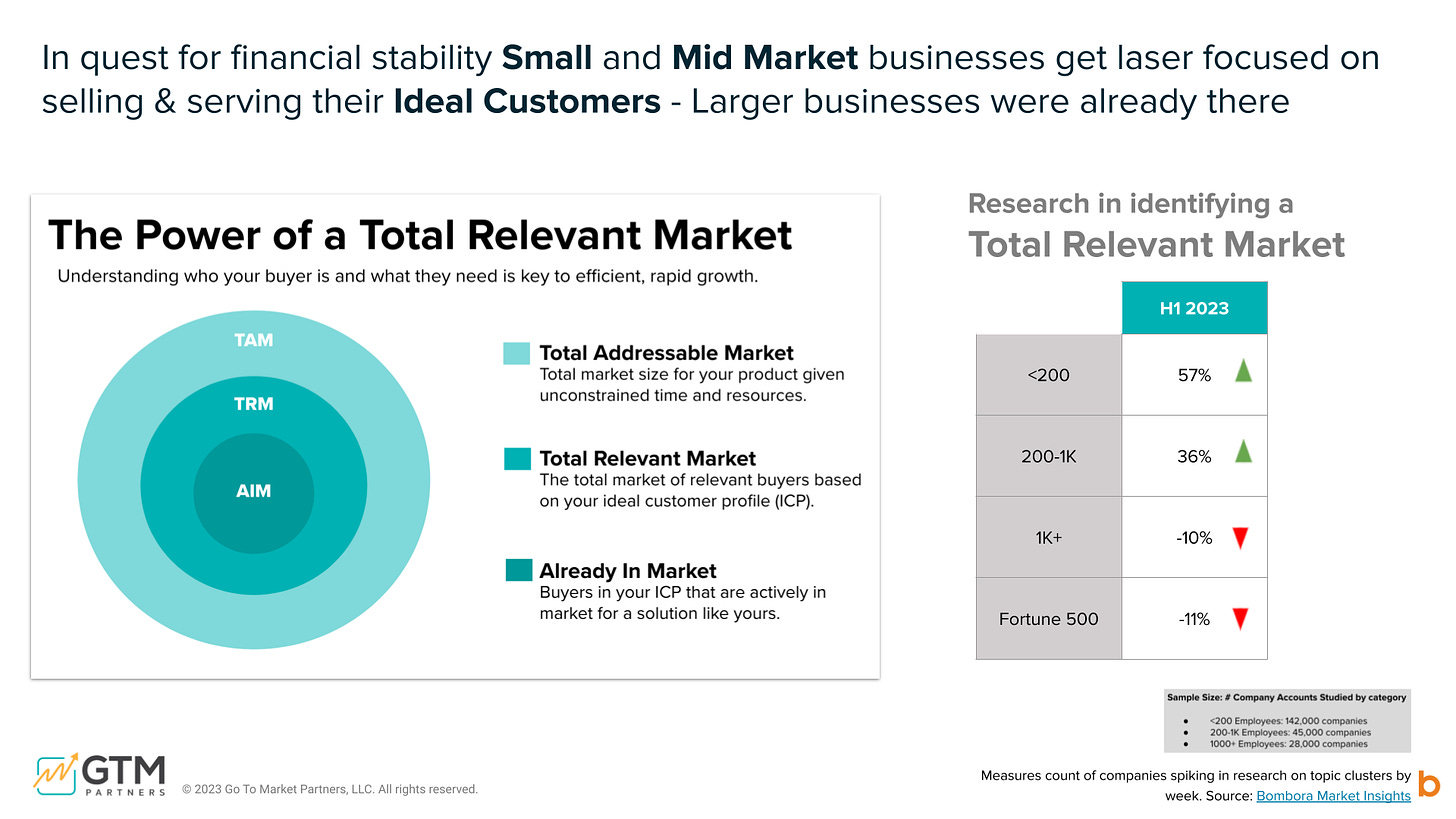

4. Focus on your TRM

In a tough economic time, your tendency may be to sell to a broader audience. Sell anything to anyone who will buy! Some will churn, some won’t, we’ll figure it out later.

The opposite is true.

We cannot afford to sell to bad-fit customers.

Our research shows that in smaller companies (under 200 employees), we see a 57% increase in their attempts to focus on their ICP. Mid-size companies increased their efforts by 36%. Large companies probably already know who their ICP is.

According to analyst Bryan Brown, “the further you are as a company in your lifespan, the more likely you've already figured out who you should and shouldn’t be selling to. The earlier you are on, the more likely you've sold a lot of junky deals to weather the storm that is now troubling your company and wreaking havoc on renewal rates.”

How should you incorporate this data into your planning?

No matter how big your company is, be sure every dollar in your proposed plan is going to market to an ideal customer.

In your plan, show exactly who your Total Relevant Market (TRM) is and be very clear and prescriptive about your efforts to reach them and not waste time and effort on the totality of your Total Addressable Market.

Better yet, use data and insights to identify and focus on those already in market.

If you don’t know who your TRM and AIM accounts are, it’s worth figuring that out as part of the planning process. How can you allocate resources and dollars otherwise?

Tip for planning from Bombora CMO Jeff Marcoux: Do a historical buyers’ journey analysis. Look at all the deals from the last 12-18 months that you want to replicate. Include only deals that didn’t churn, had good profitability margins, etc.

What was their research journey 18 months before they bought? How can you map that journey to top of funnel, middle of funnel, and bottom of funnel? Then how can you effectively and efficiently target GTM strategies like advertising and SDR efforts to the right accounts at the right time?

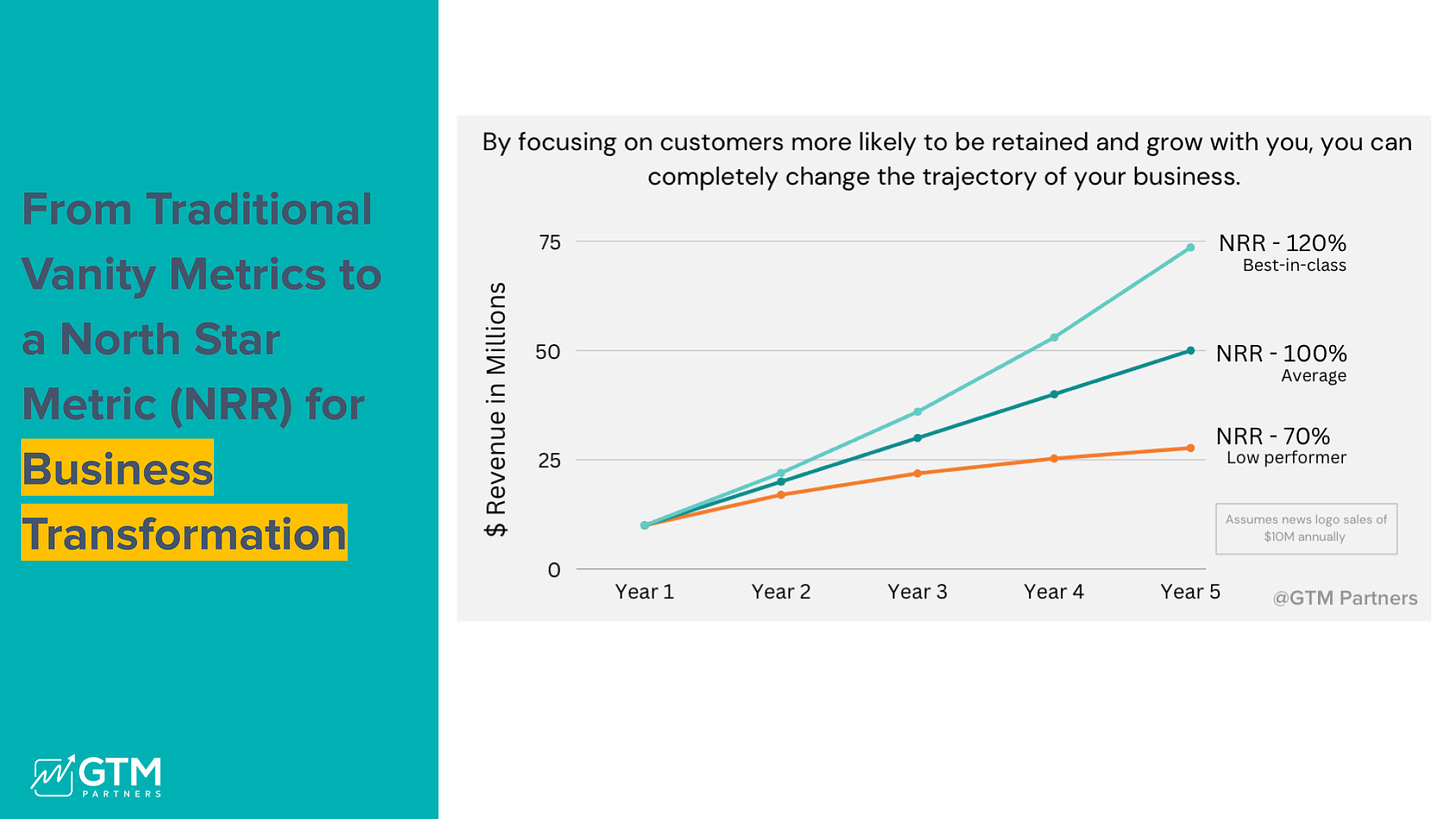

5. Focus on NRR

Five years ago, only best-in-class companies were focused on NRR.

However, a few years ago, we see more and more companies adopting NRR as a north-star metric.

How should you incorporate this data into your planning?

If you are a GTM leader in any discipline who is focused only on metrics like MQLs, SQLs, or even ARR, you are missing a huge opportunity to level up your strategic game.

Quite simply, if you aren’t already focused on NRR, you should propose it. With 120% NRR, for a $35M business, you can double your revenue every 5 years with no new customers.

If your company is already focused on NRR at the executive level, make sure your plans and proposals include your projections on how they could impact NRR.

Lessons and Takeaways

Hopefully you can use at least a few of these statistics in your Q4 or 2024 planning cycle. But if those 5 things weren’t enough, here are some high-level takeaways from our economic impact research.

Make generative AI a part of your efficient growth strategy.

Reimagine your sales & CS motion; the old system was broken and is not coming back

Grow through your best customers and find more of them (TRM)

Ensure you have a clear ROI story to retain existing customers

Reinvest in building brand and demand to get pipeline back on track

A GTM dashboard is imperative to align and activate teams

NRR is your single most important metric to focus on right now

A Call for GTM Jobs, News, Announcements, Events, and Testimonials!

The GTMonday newsletter is always growing and expanding.

Our goal is to give you actionable, though-provoking data and research every Monday.

We also want to be a resource for Go-to-Market leaders beyond sharing our own data. As such, we’d like to open a call for the following:

GTM-focused job openings

Industry events focused on GTM functions

GTM research/data

GTM testimonials

Big company news that is legitimately of use or interest to a broad GTM audience.

We have a limited number of spots in each newsletter, and inclusion will be on a first-come, first-served basis.

We hope this has been useful as you think about your next planning and ideation cycle. One last share that might also be helpful: 6 frameworks for GTM leaders.

Happy end of summer!

Love,

GTM Partners

P.S. If this all feels overwhelming, we can help. Our analysts are brilliant and are helping companies every single day with problems like:

Identifying Total Relevant Market, ICP and better understanding scoring and intent data

Deciding which products and markets to invest in and how to structure pricing and packaging

Understanding brand and demand, including creating a differentiated point-of-view and leveraging the right GTM motions at the right time.

How to increase pipeline velocity by leveraging the right sales plays and methodologies

How to improve customer time to value through onboarding and customer success plays and understanding ROI

How to improve customer expansion through cohorts, account management plays, and CLTV

How to make RevOps a single source of truth that unifies data and systems

The role of leadership and management in a GTM strategy