Filters

New Research: Why Inorganic Growth Belongs in Every CEO’s Toolkit

Thanks for being one of over 175,000 forward-thinking GTM Leaders who subscribe to this weekly research note.

This week’s research note includes:

GTM Research: M&A Playbook: Why Inorganic Growth Belongs in Every CEO’s Toolkit

GTM OS Certified Partner Spotlight: Lydia Flocchini, Motion to Scale™

Upcoming Events and Access

M&A Playbook: Why Inorganic Growth Belongs in Every CEO’s Toolkit

Written in collaboration with Metropolitan Partners Group

Why Now Is the Time to Rethink Growth

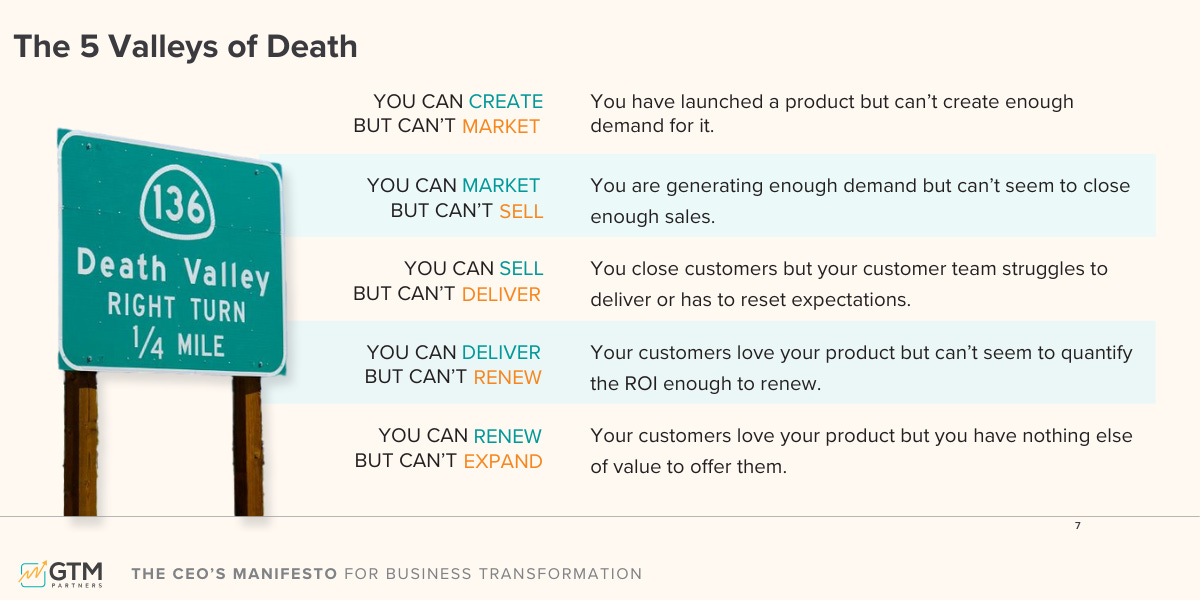

For years, growth playbooks have leaned heavily on organic strategies: acquire customers, launch products, expand accounts, optimize operations.

But as customer acquisition costs rise and budgets tighten, those paths are becoming harder to sustain.

The companies that thrive in the next era of growth will be the ones that expand their playbooks.

Inorganic growth through mergers and acquisitions (M&A) is no longer a lever reserved for the Fortune 500.

It is a tool that mid-sized companies, owner-operators, and growth-stage startups can and should use to scale smarter and faster.

“M&A isn’t just for large enterprises with deep pockets. It is a strategic lever that can catapult a business of any size forward.” ~George Alifragis of Metropolitan Partners Group

The Three Pillars of a Modern M&A Playbook

Too often, executives hesitate to pursue acquisitions because the process feels overwhelming or reserved for specialists. Our research shows that success can be boiled down to three pillars:

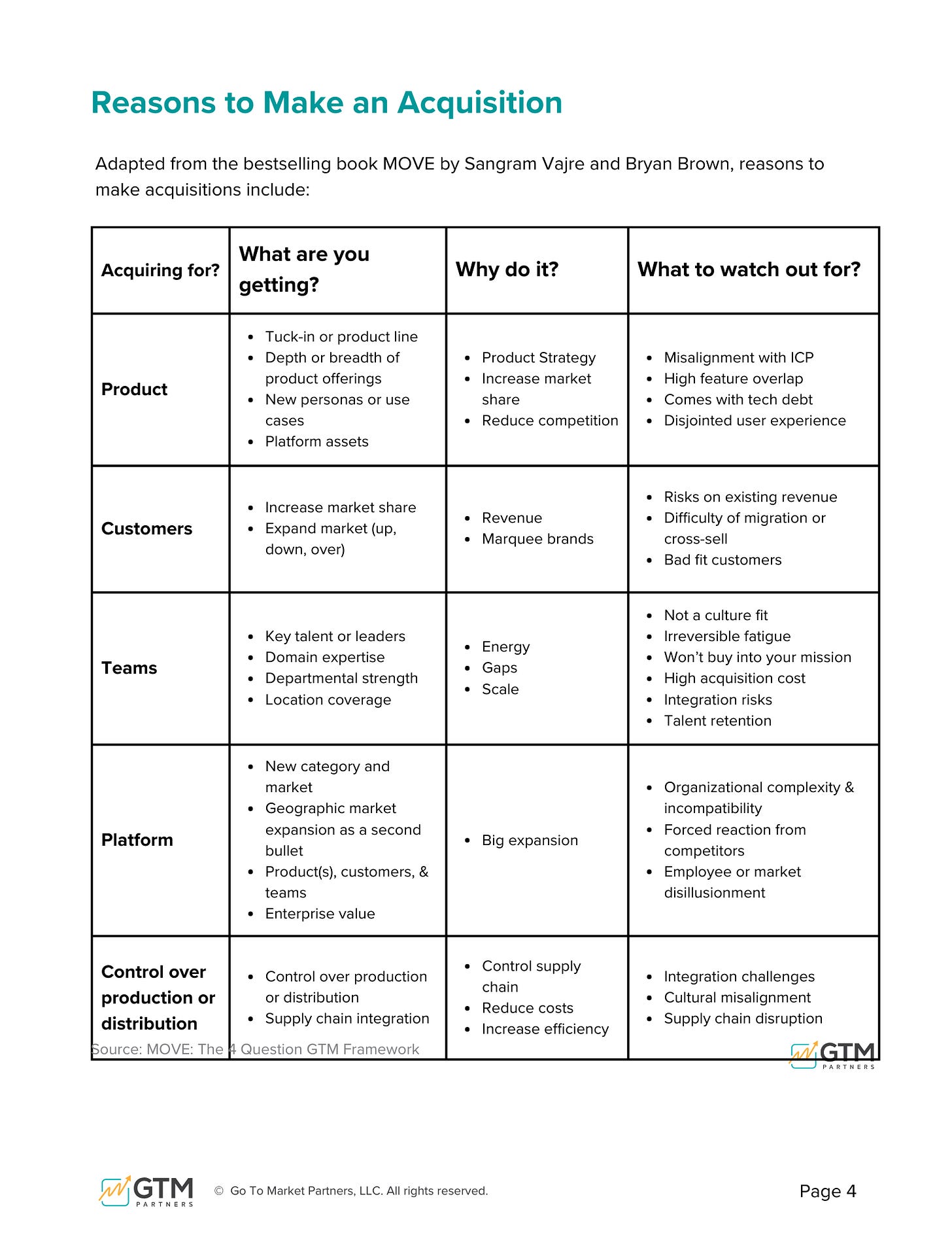

Identify – Get clear about what you are acquiring and why. Are you buying customers, products, talent, or platform capabilities? Is the acquisition horizontal, vertical, or adjacent?

Fund/Finance – Decide how you will structure the deal. Debt is often more efficient than equity, but the right structure depends on your risk tolerance and goals. The key is to have financing ready so you can move quickly.

Integrate – Where many deals fail. Cultural fit, communication, and technology integration must be addressed before the deal closes. Without a structured integration plan, companies risk losing the very value they set out to acquire.

Debunking the Myths

M&A comes with its fair share of myths. Some believe it is too expensive, too complex, or only viable for large companies and private equity firms. The truth is more nuanced:

Acquisitions can be faster and more cost-effective than organic growth when CAC is rising.

Integration does not always need to be complex. In some cases, limited or targeted integration is enough to realize the benefits.

Smaller companies can unlock enormous value by acquiring customer bases, technologies, or specialized talent they cannot build quickly enough themselves.

Why M&A Matters More Than Ever

The current market presents a unique window. Valuations are under pressure, creating attractive buying opportunities. Many industries are fragmented, opening the door for consolidation. And technological change is moving so quickly that the only way to access capabilities fast enough may be through acquisition.

The risk is not that M&A is too bold. The risk is waiting too long and watching competitors capture the best targets.

How the GTM O.S. Fits In

Our GTM Operating System provides an 8-pillar framework that helps companies evaluate potential acquisitions before and after the deal. Pre-acquisition, it guides leaders on market potential, customer base, and operational health. Post-acquisition, it supports integration with a focus on RevOps, customer expansion, and brand unification.

The goal is simple: transform M&A from a high-stakes gamble into a repeatable capability for growth.

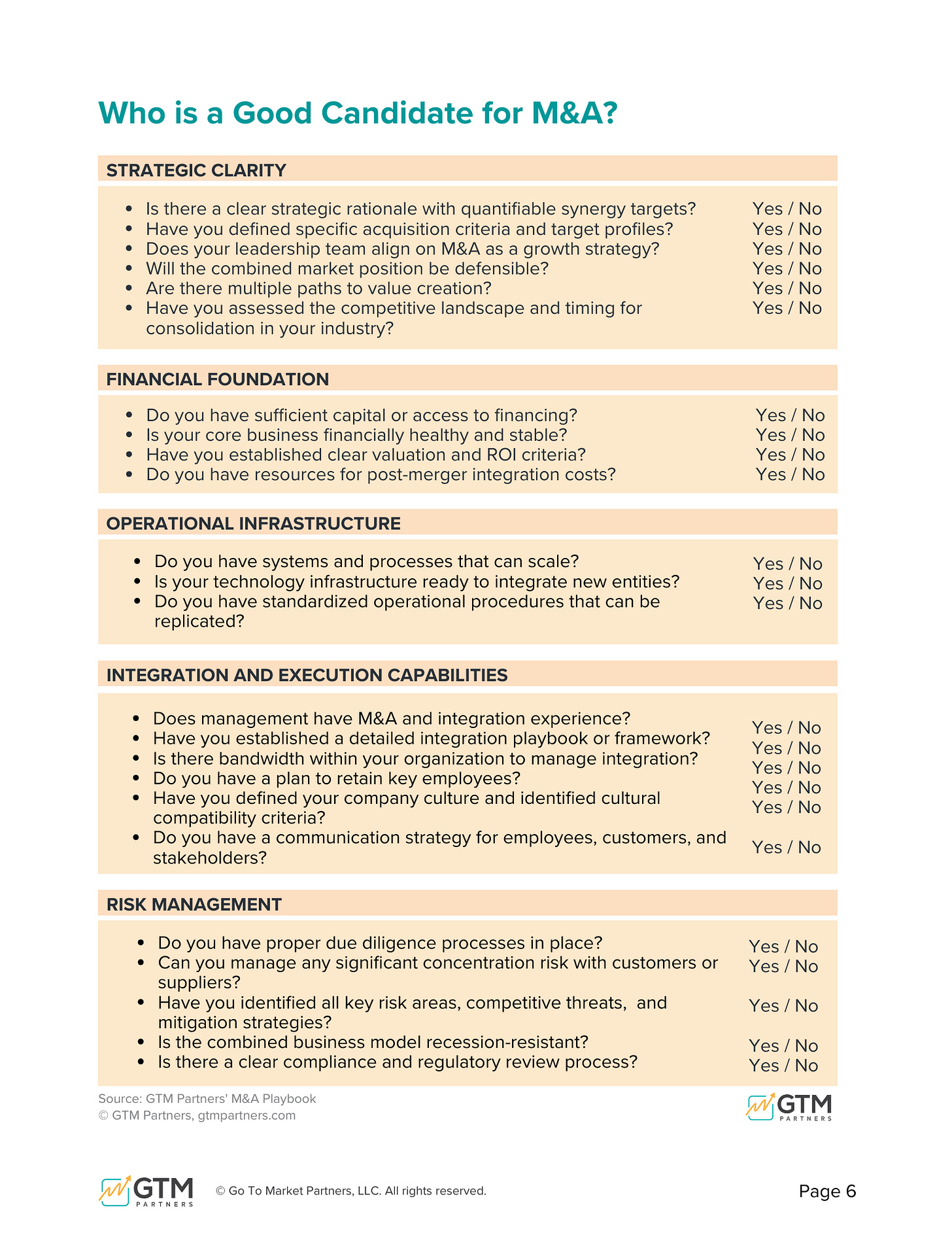

A Blueprint for Transformative Growth

With the right playbook, M&A can be more than a financial transaction. It can be a disciplined way to leapfrog competitors, expand markets, and build resilient organizations. The combination of strategic clarity, financial readiness, and integration excellence separates those who unlock value from those who destroy it.

That is why we partnered with Metropolitan Partners Group on this research: to show leaders of all sizes how to make M&A a practical, actionable part of their growth strategy.

For companies considering M&A, the first step is evaluating whether it fits within their overall growth strategy.

Ask questions such as:

Does the company have the financial capacity for an acquisition?

Is there a clear strategic fit between the target company and the acquirer?

Is there a plan in place for funding and integration?

Once these foundational questions are addressed, the decision to pursue M&A becomes clearer, allowing executives to make informed choices about how best to leverage inorganic growth as part of their overall strategy.

Keep Building Your GTM Edge: Join GTM University

At GTM University, we focus on the fundamentals that matter most to every growth leader: aligning teams, turning insight into execution, and building repeatable plays that work across markets and motions.

Whether you are leading marketing, sales, product or CS…. whether you are running inbound, outbound, product-led, partner-led, event-led, or community-led growth, GTMU is where leaders sharpen strategy and learn from peers facing the same challenges.

If you want to stay ahead of the curve and close the gap between what you know and how you execute, GTM University is the place to start.

GTM University is built on the GTM Operating System™—a proven, stage-based framework for aligning your teams, defining your strategy, and executing efficiently across the entire revenue engine.

Your playbook for efficient growth is here. Learn how to use it.

Certified Partner Spotlight: Lydia Flocchini, Motion to Scale™

Category Design & Revenue Strategy for Legal Tech Founders

Legal tech growth doesn’t stall because founders aren’t working hard enough—it stalls because traditional GTM playbooks weren’t built for the unique challenges of legal innovation. That’s where Lydia Flocchini and Motion to Scale™ come in.

As the first GTM and category design advisory built exclusively for legal tech, Motion to Scale™ helps founders and CEOs escape the Scaling Stall—the slow sales cycles, leaky pipelines, and stalled adoption that silently drain momentum. Lydia’s proprietary Legal Tech Revenue Science™ framework turns legal tech founders into revenue-first CEOs, aligning strategy, messaging, and execution to unlock predictable growth and exponential customer value.

With decades of real-world GTM experience, Lydia helps legal tech leaders stop competing within crowded markets—and start owning them.

Where Motion to Scale™ Delivers:

Legal Tech Revenue Science™ implementation

Category design and market leadership

Unified GTM strategy tailored to legal tech

Fractional executive guidance with hands-on support

Redefine how you grow—and lead—in legal tech.

Learn more: Lydia Flocchini Partner Page →

If you’d like to be a certified GTM Partner like Lydia and many others, we’d love to talk to you about how to make that happen.

Upcoming Events: Where We’ll or a GTM Certified Partner Will Be Speaking in 2025

(DM Sangram for a discount code to attend or to get slides after the talk)

Fix Your Revenue Leaks - A GTM Workshop (hosted by GTM Certified Partner Sandy Yu) is running 7 city roadshow on 15 GTM problems in a city near you and there are 6 more to go: Seattle (Sept. 9), Amsterdam (Oct. 9), Copenhagen (Oct. 16), Singapore (Nov. 4), New York City(Nov. 13), Melbourne (Dec. 3)

DRIVE 2025 (hosted by Exit Five). September 10-11, Burlington, VT

Usage Economy Summit (hosted by LogiSense) Nov 5, San Francisco

Love,

Sangram and Bryan

p.s. Access GTM University | Hire GTM OS Certified Partners | Read Fractional Friday

Thanks for reading GTMonday by GTM Partners!

Subscribe for free to receive new posts and support our research work.