Filters

Knowing Your Total Relevant Market Boosts Sales Success by 67%

Thanks for being one of more than 55,000 forward-thinking GTM Leaders who subscribe to this weekly research note. We aim to be the go-to for go-to-market, so we appreciate you reading and sharing when you see something you like!

This week’s research note includes:

GTM Research: The importance of thoughtful, detailed TRM

GTM Poll of the Week: Is your GTM team all aligned on TRM?

GTM is Better Together: Announcing our MC’s!

GTM Events: Events you should know about

GTM Research:

A weekly deep-dive into new GTM research and insights

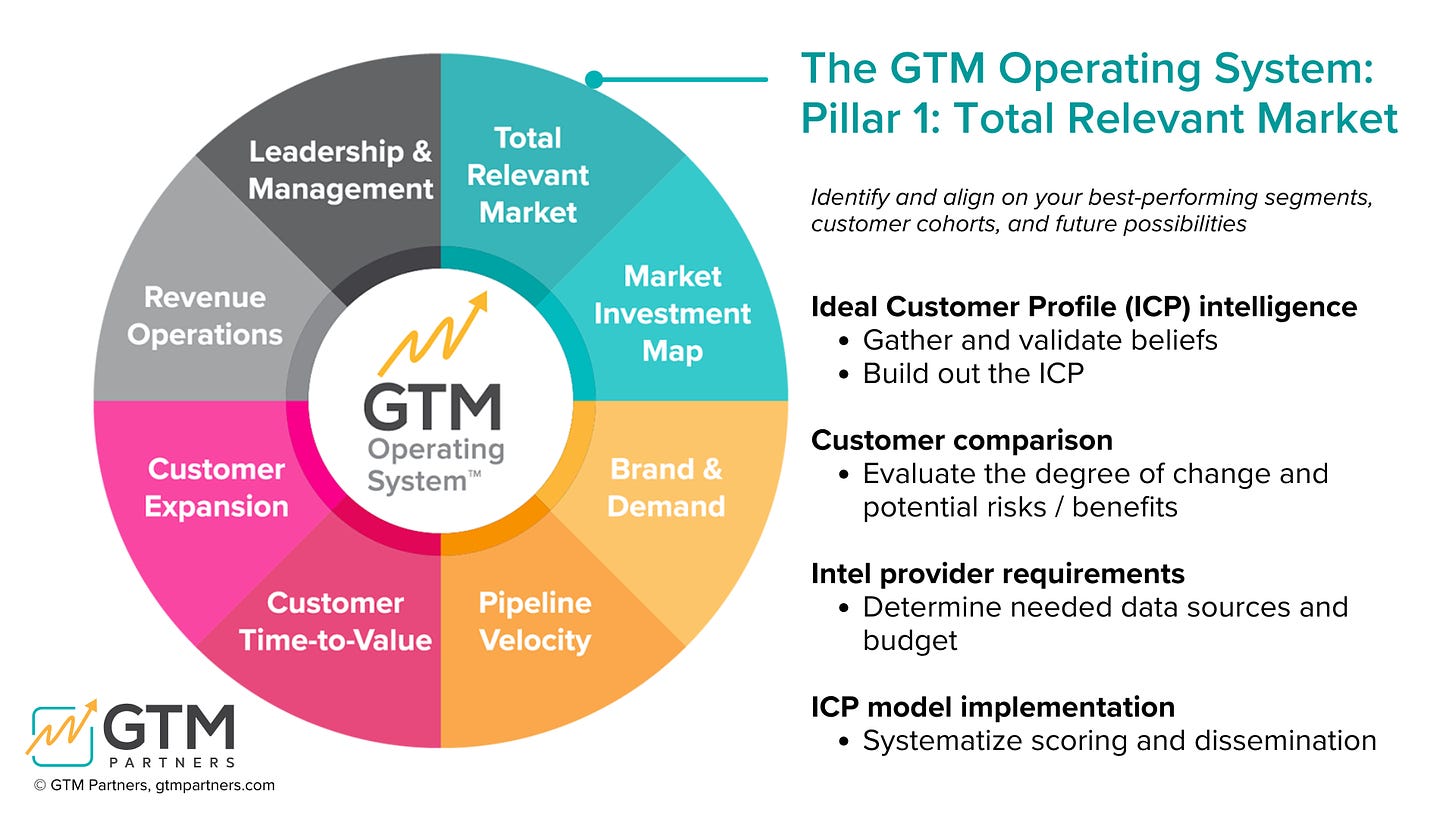

The very first pillar in our GTM Operating System is Total Relevant Market (TRM).

There’s a reason for that: it’s foundational to a successful, strategic GTM.

Everything else a GTM team does (messaging, marketing, selling, servicing, upselling) all depends on who is at the receiving end.

Why should you care?

Companies with a well-defined TRM and ICP get more customers and more revenue:

50% more likely to acquire new customers (Hubspot)

30% more generated from marketing (Sirius Decisions)

67% more likely to exceed sales targets (McKinsey)

But listen to this:

According to McKinsey, 50% of startups have successfully converted less than 10% of their ideal potential customers into actual customers. In other words, a significant portion of their potential market is not being reached or converted.

If a startup fails to engage and convert at least 10% of their ideal customers, their chances of surviving over the next five years drop by 50%.

In other words, having a low percentage of ideal customers directly impacts the longevity and success of the startup.

The Difference Between TAM, TRM and ICP

Total Addressable Market (TAM)

TAM is everybody you can sell to without any consideration of who would be a best-fit customer.

What might a TAM look like for a SaaS company that sells project management software?

All businesses worldwide that could potentially use project management software.

The estimated TAM is $10 billion based on the total global spend on project management software.

Total Relevant Market (TRM)

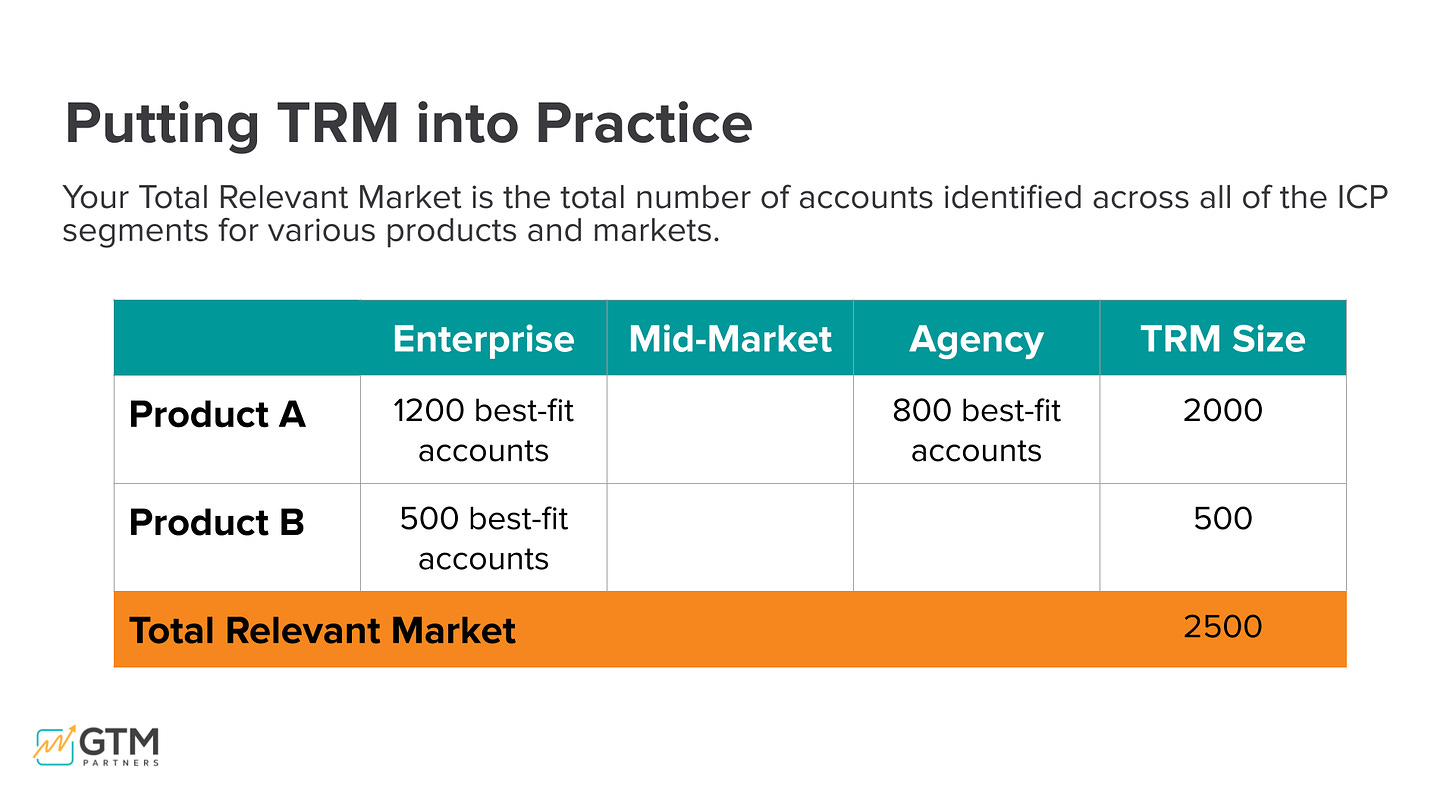

If TAM is the buyers a business CAN target, TRM is a sub-segment that the business SHOULD target. TRM is the group of buyers who are most likely to appreciate what you’re doing today. It is the total number of accounts identified across all your ICP segments (see Putting TRM into Practice below):

The TRM looks more like:

Mid-sized tech companies

Based in North America

That need cloud-based project management solutions

And have appropriate budgets for the pricing

This TRM might narrow down the market from a $10B TAM to a $1 billion TRM by targeting businesses that fit within specific geographic, industry, and budgetary constraints.

Ideal Customer Profile (ICP)

TAM is who you COULD target.

TRM is who you SHOULD target.

ICP is your best-fit customers who are mostly like to convert, renew, and expand.

You could have multiple ICPs within one TRM.

Here’s the way narrowing down your TRM into an ICP might play out

Tech companies

with 100-500 employees

Located in major North American tech hubs like San Francisco, Seattle, and Toronto.

Often manage complex projects

Have a growing team

Need advanced collaboration features

Have a dedicated budget for project management tools

Looking for scalable solution

You might have a second ICP with all those same characteristics but in another industry or region.

We’ve whittled our market from a $10B TAM to a $1B to TRM to a $100M ICP.

That may seem crazy to narrow your potential scope (and investors don’t always love it), but the more you whittle, the better you can tailor and customize product features, messaging, and value to them.

It will be much easier for you to go-to-market to the ICP than it will to the TAM in the above example.

This is what it looks like if you take an account view:

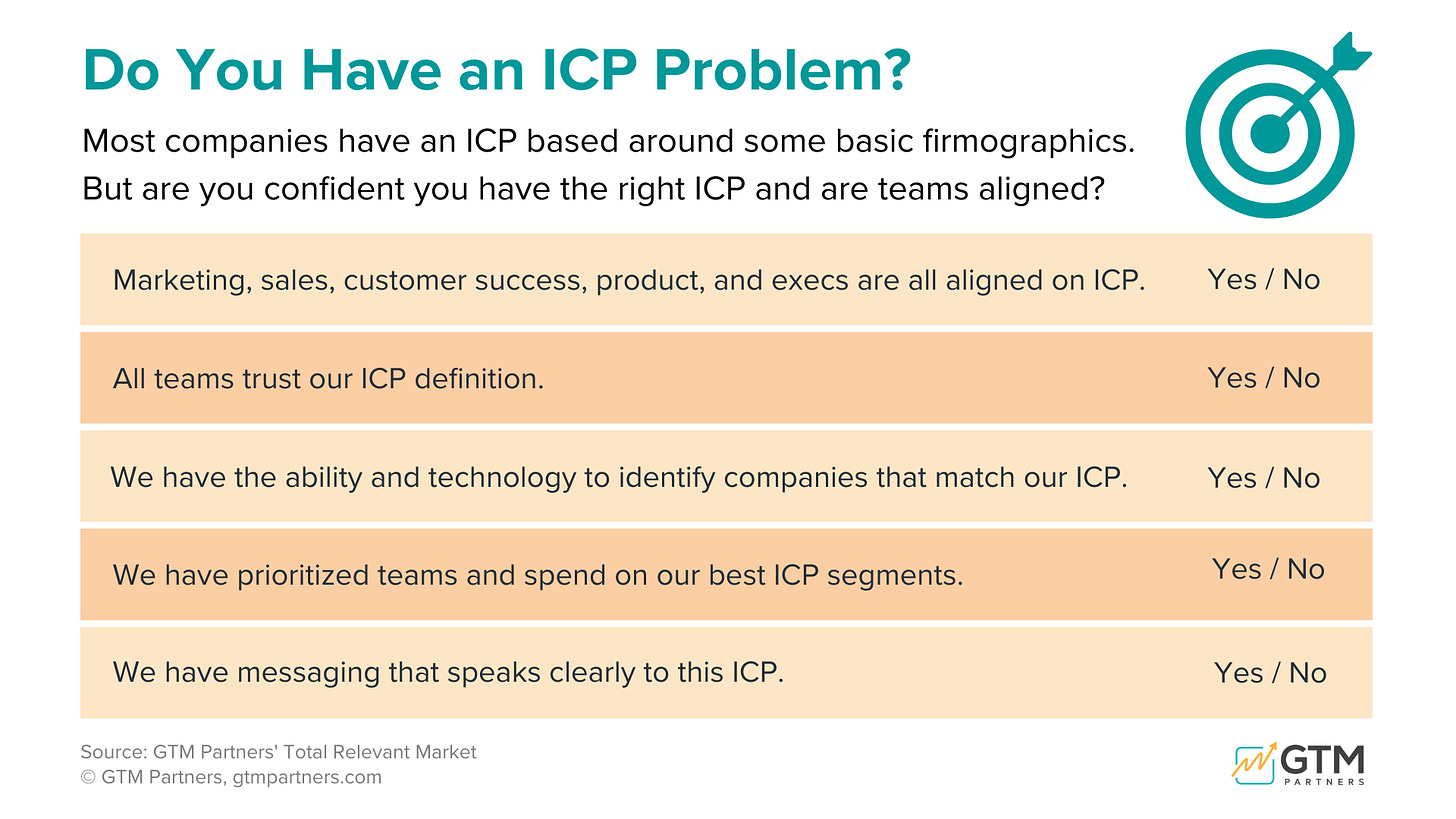

Do you have an ICP Problem?

You might have done all the hard work to define your ICP but if the rest of the organization doesn’t know about it or trust it, you still have a problem.

If you answered “no” to any of these questions, you should make ICP an immediate priority for your organization.

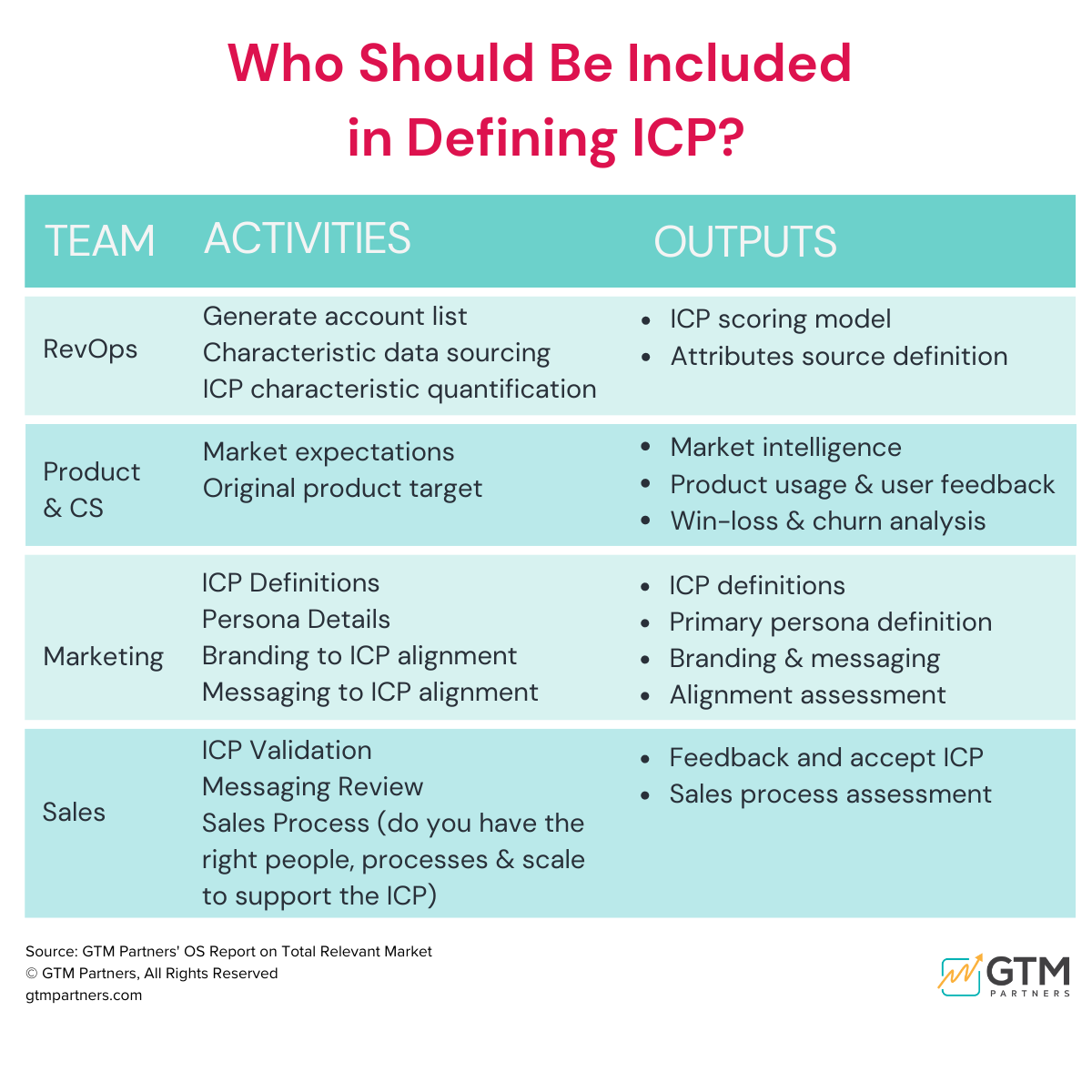

Which GTM teams should influence the ICP?

If you know us well, you already know what we’re going to say.

ALL GTM teams should be included.

Here are the roles they should play:

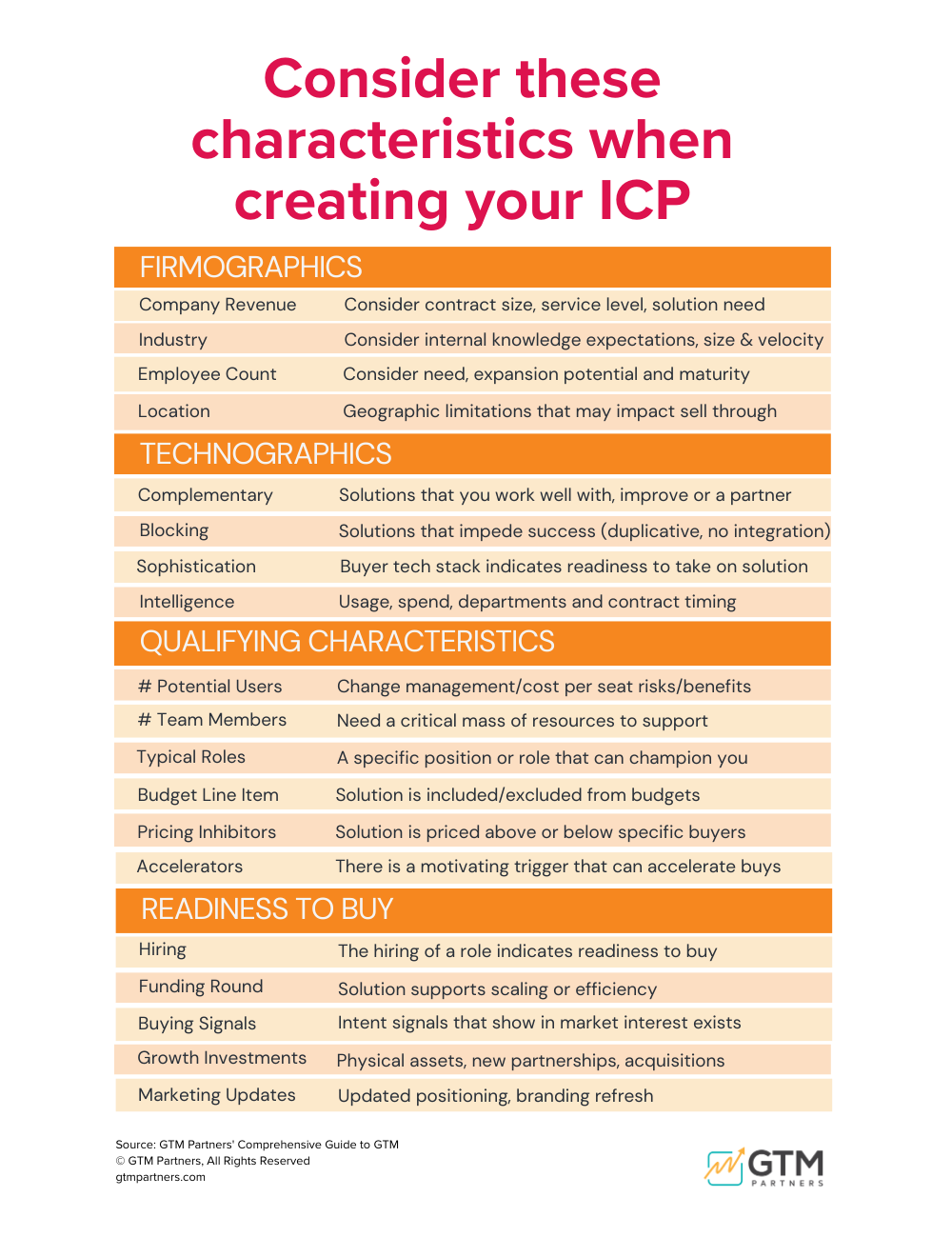

What characteristics should you be considering?

By including these characteristics, you will have a clearer understanding of your ICP:

Firmographics: Bread and butter direction for your organization - can often be the only thing people discuss which can be a mistake.

Technographics: Think outside the box in terms of how technology information can enrich your profiles. While software companies will have natural “fits”, any company can deduce sophistication from technology even if they don’t sell tech themselves.

Qualifying Characteristics: This is the most nuanced and company-specific set of requirements. Internal facts that make them a good fit for your solution.

Readiness to Buy: What factors would put a company in a place to enter into a buying cycle. Behaviors that show they are “In Market” to buy.

We have made all our frameworks and reports related to TRM and ICP available on our Hub for anyone to use.

If you feel like you need a little more help, we’d love to talk through our process with you.

GTM Poll of the Week

GTM is Better Together: News and Updates

“GTM is Better Together” is a revolutionary new vision that the future of GTM is better together with unified teams, tech, and trust. This is a weekly feature where we will share the latest announcements related to this important initiative.

Ticket requests are open for all four shows!

August 28, 2024: Atlanta, GA

September 10, 2024: Boston, MA

October 22, 2024: New York City, NY

November 20, 2024: San Francisco, CA

Comped pairs of tickets (so you can bring a colleague from another department) are available if you meet all three of these criteria:

You’re a senior GTM Leader (marketing, sales, customer success, product, RevOps, or the leadership team)

You work for an enterprise company

You are a customer of one or more of our partners for this event (Demandbase, Clari, On24, Vidyard, Totango, Catalyst, MadKudu, G2, Technology Advice, or ZoomInfo)

If you meet the first two criteria but are not a customer of any of those companies, you can apply for a ticket here:

Hope to see you there!

GTM Events

A list of upcoming events of interest to GTM professionals

July 9-11, London: GTM EMEA from Pavilion- our analyst Lindsay will be speaking on unifying GTM across different geographies and cultures.

August 28, Atlanta: GTM is Better Together

September 10, Boston: GTM is Better Together

September 18-20, Boston: INBOUND 2024

October 16, Austin: GTM Made Simple Roadshow

October 22, NYC: GTM is Better Together

November 20, San Francisco: GTM is Better Together

Are you a B2B company between $10-100M in revenue who needs help with your GTM strategy and execution? We’d love to chat.

Happy July 4th to our American readers!

Love,

The GTM Partners Team