Filters

All The Data You Need For 2026 GTM Planning

Thanks for being one of over 178,000 forward-thinking GTM Leaders who subscribe to this weekly research note.

This week’s research note includes:

GTM Research: The Data Behind the 2026 Rules of GTM

GTM OS Certified Partner Spotlight: Ken Kramer

Upcoming Events and Access

Research: The Data Behind 2026 Rules of GTM

We got so much positive feedback from last week’s deep dive into High Alpha’s latest SaaS Benchmark Report that we decided to go a step further.

This week, we pulled insights from every major 2025 GTM research report we could get our hands on. What follows is a curated summary of the data that matters most for your 2026 planning with context on what to do about it.

If your 2026 plan looks like your 2024 plan with a few AI tools added, you’re already behind.

Across every report, the pattern is the same: growth leaders aren’t chasing tactics. They’re building systems. They’re connecting markets, motions, data, and leadership into a single operating rhythm.

Here’s what the research says about how to do that.

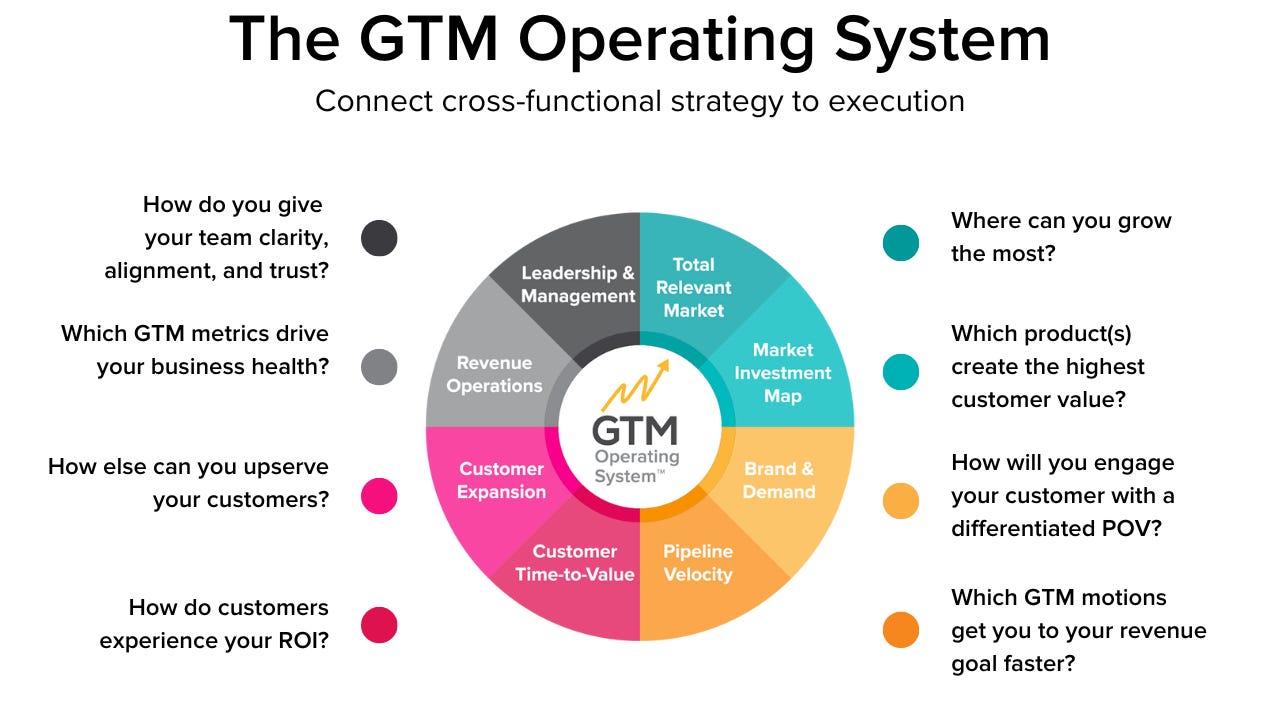

The Lens: The GTM Operating System

The insights below are organized using the GTM Operating System (GTM OS) — the framework we use to help companies build repeatable, aligned growth. It connects eight core pillars, from defining your market to leading your team.

Each section highlights new data from this year’s major research reports, what it means for your business, and how to apply it in your 2026 planning.

Ok, let’s dig into what the data shows.

Act I: Where Growth Comes From: Defining your market and choosing your bets

Most GTM plans start with channels or tactics. The smart ones start with markets. Act I looks at where real growth still exists—who your best customers are, how big your true opportunity is, and which products deserve the next dollar of investment.

Pillar 1. Total Relevant Market

Question: Where can you grow the most?

The B2B Institute reconfirms the 95–5 Rule that ABMers have been sharing for ages: 95% of potential buyers are out of market at any time. Only 5% are actively shopping this quarter.

McKinsey adds urgency: Half of startups have converted less than 10% of their ideal potential customers, and those that fail to hit that threshold are 50% less likely to survive five years.

Your “total relevant market” is mostly future buyers. Growth depends on how well you reach and stay remembered by them.

What to do in 2026:

Redefine your TRM beyond active intent signals.

Model your full ICP universe and measure penetration.

Invest in brand memory, not just in-market demand.

If you only market to the 5% in cycle, you’ll always cap your growth.

Pillar 2. Market Investment Map

Question: Which products create the highest customer value?

High Alpha shows hybrid pricing models deliver the highest retention (≈105% NRR) while outcome-based pricing drives the fastest growth.

G2 backs that up: one in three B2B buyers now prefers variable pricing models, and mid-market buyers are rejecting long-term, fixed-fee contracts.

Forrester adds that buyers are increasingly aligning spend with perceived outcome certainty, favoring vendors who demonstrate flexibility and proof of ROI.

What to do in 2026:

Audit your pricing and packaging.

Add a hybrid or outcome-based tier tied to measurable results.

Pilot in expansion cohorts first, then scale.

Rebalance investments toward category-wide reach, not micro-segments.

Pricing strategy is now a growth driver, not a back-office exercise.

Act II: How Revenue Actually Moves: Turning brand, demand, and customer experience into predictable motion

Deals don’t close because of strategy slides. They close because your brand earns attention, your team moves fast, and your customers see value early. This section breaks down what the latest research shows about the motions that create and sustain momentum.

Pillar 3. Brand and Demand

Question: How will you engage customers with a differentiated point of view?

Hubspot says 92% of marketers plan to maintain or increase brand investment, and 65% say value-driven storytelling improved performance.

Meanwhile, AI has rewritten the discovery journey. G2 found AI search now rivals or surpasses Google for enterprise software discovery, with leads from AI search converting 40% better than traditional search.

McKinsey reports that AI use in marketing and sales is the top driver of revenue impact, ahead of product or operations.

What to do in 2026:

Ensure your content is crawlable by AI models (GPTBot, Google-Extended).

Optimize for generative engine optimization (GEO).

Anchor campaigns in a strong point of view and brand values.

Pillar 4. Pipeline Velocity

Question: Which motions get you to revenue faster?

Ebsta found top sellers close deals three times faster, generating 11 times more revenue per day than peers. Deals that slip more than two months see win rates drop by over 100%.

Forrester adds that teams using AI-driven pipeline prioritization see 15–20% higher forecast accuracy and 30% faster conversion rates.

What to do in 2026:

Audit your pipeline by stage and velocity.

Automate alerts for slippage.

Tie manager reviews to velocity, not raw activity.

Reward disciplined qualification.

Volume doesn’t win. Velocity does.

Pillar 5. Customer Expansion

Question: How else can you upserve your customers?

High Alpha found that beyond $50M ARR, 60% of new ARR comes from existing customers.

Ebsta adds that sustained engagement increases expansion likelihood by 189%, and strong C-suite relationships double expansion rates.

HubSpot’s data echoes this: marketers focused on retention and advocacy see 20% higher ROI than those focused purely on acquisition.

What to do in 2026:

Make expansion ARR a primary revenue target.

Tie comp to engagement quality and relationship depth.

Instrument engagement scoring in CRM.

In a cautious market, expansion is the safest path to durable growth.

Pillar 6. Customer Time to Value

Question: How fast do customers experience the outcome they bought?

Across the reports, the signal is consistent.

G2: Time to first outcome is a top selection and renewal driver. Buyers favor vendors that show value in weeks, not quarters.

High Alpha: Companies that systematize value realization see stronger NRR and more predictable expansion.

HubSpot: Post-sale enablement content and onboarding journeys correlate with higher retention and referral rates.

Forrester: Value realization programs shift from “nice to have” to executive-owned motions tied to revenue.

Ebsta: Early, multi-threaded engagement with post-sale stakeholders raises renewal and expansion probabilities.

Gartner: Product analytics and usage telemetry must feed CS workflows in real time to shorten activation.

McKinsey: AI assistants accelerate onboarding through guided setup, in-product coaching, and role-based personalization.

What to do in 2026:

Define “first value” by segment. Write it down. Make it observable and binary.

Build a 30-60-90 value plan. Outcomes, owners, milestones, risks, and next best actions. Share it on day one.

Instrument activation. Track feature adoption, role coverage, and license utilization by account and by persona.

Use AI for onboarding. Guided checklists, contextual tips, and automated nudges tied to usage events.

Timebox implementation. Standardize a fast-path package that gets a typical customer to first outcome within a fixed window.

Make value reviews routine. Run EBRs that quantify realized outcomes, not activity. Put a dollar figure on it.

Tie comp to outcomes. Pay CSMs and AEs on verified value and expansion, not tickets closed.

Close the loop with product. Pipe churn and value blockers into the roadmap with measurable fix targets.

If you do one thing: decide your First Value moment, publish the 30-60-90 plan, and hold teams accountable to Days to First Value by segment.

Act III: What Makes It All Work: Building the systems and leadership that sustain growth

Even the best GTM motions collapse without clean data and steady leadership. The final act looks at how top companies use systems, analytics, and culture to create accountability, clarity, and resilience across the entire go-to-market engine.

Pillar 7. Revenue Operations

Question: Which GTM metrics actually drive growth?

Ebsta found 44% of seller interactions never make it into CRM, and 26% of missing contacts are decision-makers. Companies with complete data achieve 10% higher forecast accuracy and stronger AI outcomes.

Gartner calls analytics “ubiquitous,” meaning every team must now function as a data team.

HubSpot’s report found AI-powered analytics is among the top three ROI drivers for marketers.

What to do in 2026:

Automate data enrichment and set CRM hygiene standards.

Require verified stakeholder mapping before deals advance.

Use predictive ROI modeling for budget decisions.

AI can’t fix what your data breaks.

Pillar 8. Leadership and Management

Question: How do you give your team clarity and trust?

High Alpha shows founders with mentors or mental-health support grow 48% faster.

McKinsey found AI high performers are 3× more likely to have senior leaders personally sponsoring AI initiatives. One-third dedicate over 20% of their digital budgets to AI.

Leadership engagement, not tooling, separates early adopters from value creators.

What to do in 2026:

Budget for executive coaching the same way you budget for RevOps.

Define AI leadership ownership as a KPI.

Dedicate 10–20% of your digital budget to scaling and integration.

Build reflection and feedback loops into leadership rhythms.

Healthy leaders build aligned teams. Alignment builds scalable growth.

The Pattern That Connects

Every insight in this piece points to one thing: the companies that win are the ones running an operating system for growth, not a collection of disconnected initiatives.

That’s what the GTM Operating System (GTM OS) does. It connects your market, brand, GTM motions with your data, systems, and leadership.

When all eight pillars run in sync, you get alignment across every part of the business:

The strategy pillars (Total Relevant Market, Market Investment Map, Brand & POV) define where and why you play.

The execution pillars (Pipeline Velocity, Customer Time-to-Value, Customer Expansion) control how fast revenue moves.

The enablement pillars (Revenue Operations, Leadership & Management) keep the system healthy and scalable.

That’s the pattern that connects it all: growth becomes predictable because the business operates as one system, not a set of silos trying to grow in different directions.

The companies that internalize this by 2026 won’t just plan better. They’ll run better.

Your 2026 Challenge

Your plan should answer three questions:

Do we know where growth will actually come from?

Are our systems clean enough for AI to compound it?

Are our leaders equipped to run the machine we’ve built?

If not, you don’t have a 2026 plan — you have a wish list.

If you’re a CEO or GTM leader planning for 2026, don’t miss your chance to have Bryan and Sangram guide your executive GTM planning session.

👉 Only 4 spots left in the next 2 weeks

Certified Partner Spotlight: Ken Kramer

Proven GTM Leadership for SaaS Growth and Enterprise Expansion

When SaaS companies hit a growth ceiling, they don’t need more tactics—they need experienced go-to-market leadership. Ken Kramer delivers exactly that.

With a track record of scaling $3M–$30M ARR SaaS companies into the enterprise, Ken brings deep expertise in product marketing, sales leadership, and revenue strategy. At TerrAlign, he tripled software revenue and led the company through acquisition by Salesforce via MapAnything. Now, through his work at Location Analytics, he partners with growth-stage software companies to break through plateaus and build repeatable, data-driven GTM systems.

Where Ken Adds Value:

Pivoting from SMB to enterprise go-to-market

Driving six-figure ACV deals with scalable sales motions

Building integrated GTM systems across marketing, sales, and partnerships

Diagnosing misalignment and turning strategy into execution

If you’re ready to move upmarket and turn growth goals into real revenue, Ken brings the strategic clarity and operational firepower to make it happen.

Learn more: Ken Kramer Partner Page →

If you’d like to be a certified GTM Partner like Ken and more than 50 others, we’d love to talk to you about how to make that happen.

Upcoming Events: Where Sangram, Bryan, or a GTM Certified Partner Will Be Speaking

(DM Sangram for a discount code to attend or to get slides after the talk)

Fix Your Revenue Leaks - A GTM Workshop (hosted by GTM Certified Partner Sandy Yu) is running 7 city roadshow on 15 GTM problems in a city near you, and there’s only one left: Melbourne (Dec. 3)

GrowthCon Digital Marketing and AI Summit (Dec.3, Virtual). Sangram will be leading a GTM master class.

The Work Pause: a One-Hour Workday Retreat for GTM Leaders (hosted by GTM OS Certified Partner Sarah Allen-Short), December 5 and 13 from 12-1 p.m. EST on Zoom.

Love,

Sangram and Bryan

p.s. Access GTM University | Hire GTM OS Certified Partners | Read Fractional Friday

Thanks for reading GTMonday by GTM Partners!

Subscribe for free to receive new posts and support our research work.