Filters

5 Rules for Capital-Efficient Growth

Thanks for being one of more than 55,000 forward-thinking GTM Leaders who subscribe to this weekly research note. We aim to be the go-to for go-to-market, so we appreciate you reading and sharing when you see something you like!

This week’s research note includes:

GTM Research: What does the move toward capital efficient growth mean for you?

GTM Poll of the Week: is outbound working as well as it used to?

GTM Problem of the Week: can I ever be the boss if I’m not a dreamer?

GTM News

GTM Events

GTM Research:

A weekly deep-dive into new GTM research and insights

5 Rules for Capital-Efficient Growth

Only 15% of GTM Leaders frequently ask their investors and boards for help (particularly with growth challenges) and therein lies the problem.

B2B companies have been obsessed with the relentless pursuit of growth at any cost over the last few decades. However, it’s becoming clear that this approach is unsustainable.

The new watchword is efficient growth, which refers to a strategic pivot from focusing solely on growth at all costs to prioritizing profitability and free cash flow.

Even more important than efficient growth is capital-efficient growth. Capital-efficient growth takes it a step beyond just financial capital and layers in human capital and cultural capital.

Financial capital: profitability, cash flow, strategic investments, and balance sheet, which includes assets, debt, and equity

Human capital: the skills, knowledge, experience, and abilities possessed by employees within an organization

Cultural capital: the collective values, beliefs, behaviors, and social norms that shape the company’s identity and influence its operations (and how they change as a company grows and succeeds or struggles).

We’ve been talking about efficient growth here at GTM Partners all year. Conversations with Metropolitan Partners Group have got us thinking more about capital-efficient growth.

Metropolitan Partners Group is a New York-based private investment firm that provides growth capital to small and mid-sized non-sponsored businesses in the U.S.

The entire team at Metropolitan are deeply passionate about helping more companies achieve growth through capital efficiency.

They firmly believe this approach fosters greater creative problem-solving, innovation, and scalability, ultimately leading to long-term success for companies, investors, and all stakeholders..

When your mandate shifts from maximizing growth to maximizing profitability and cash flow, here’s what to consider:

Rule #1. Choose investors and board members that bring a lot to the table and let them bring it.

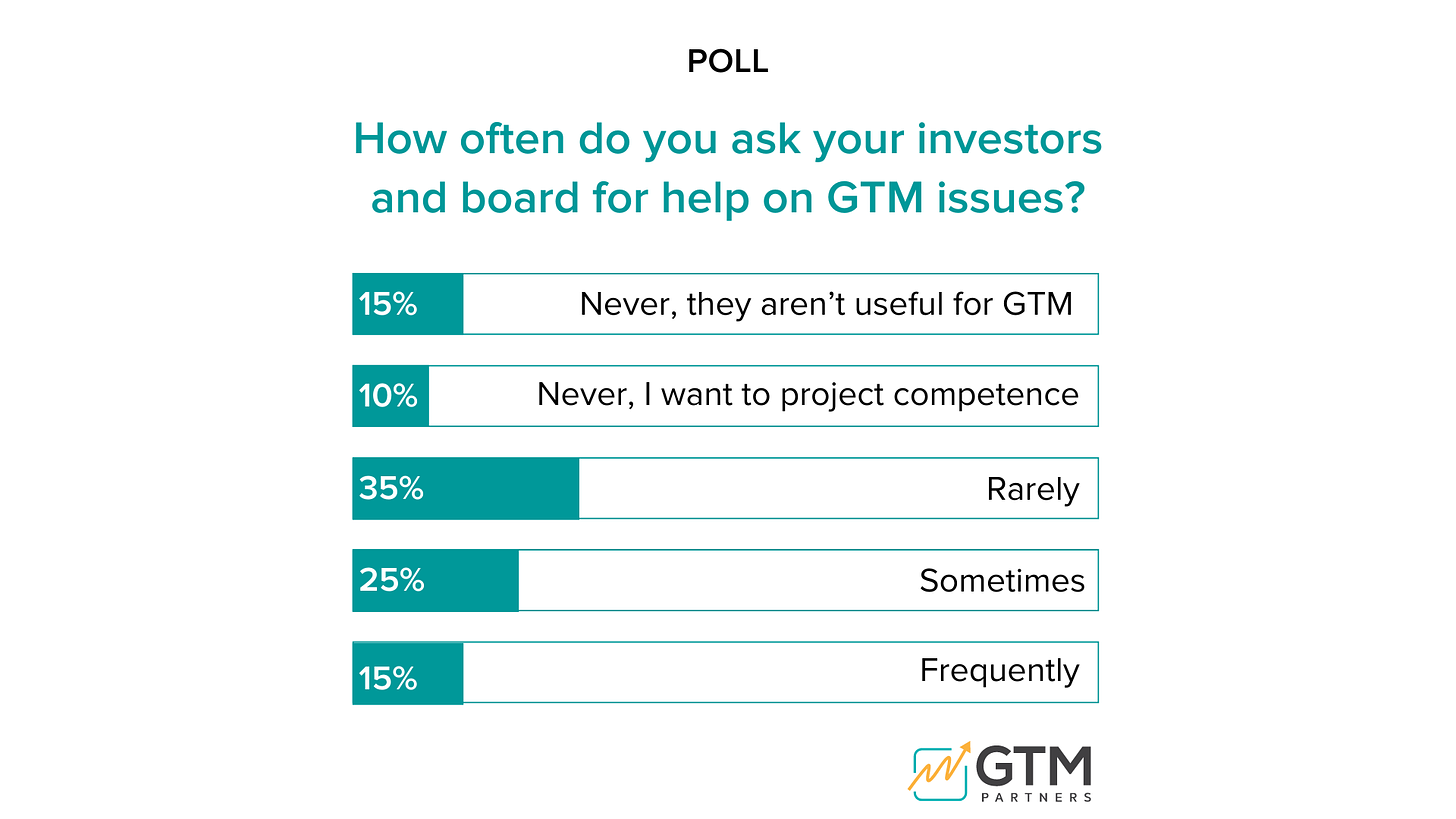

In a recent poll, we asked business leaders how often they go to their investors and board members for advice on GTM issues.

Only 15% said they do so frequently, and another 25% said sometimes.

Over 60% ask rarely or never and 15% think their investors don’t have any useful help to offer.

These results from the GTM leaders lie in stark contrast to the investor and board side of the table. Most investors offer formal or informal GTM support, and both investors and, virtually, all board members aim to be helpful and accretive.

We’ve all been in executive meetings preparing for a board presentation where we’re trying to paint the rosiest possible picture and distract from any worrisome trends.

If you got 1000 new customers last quarter, and 200 churned, you’ll be tempted to focus on the 1000 you got instead of the 200 you lost.

You may want to look like you always know what you’re doing and you want to keep or justify your job. You probably want to wait until you have the problem all figured out before telling your board there ever was one.

However, your investors–or the right investors–probably have resources that can help you and the people on your board are there for a reason.

When you’re having a challenge, consider bringing them into the fold to help you solve it before it gets out of hand.

“Who you raise your capital from is as important, if not more important, than the amount of capital you raise.”

-John Ioannou, Head of Operating Expert Network at Metropolitan Partners Group

Instead of trying to hide the problem, lead the charge towards solving it with all the resources your team brings to the table. Leaders should be proactive about identifying and solving problems that they know exist.

Rule #2. Stop throwing bodies at GTM problems you don’t truly understand.

When we’re facing a big GTM problem, our first instinct may be to try to hire our way out of it.

Not hitting revenue goals? Hire more salespeople. Don’t have a big enough pipeline? Increase your marketing team. Behind on features and releases? Grow your development team.

However, waiting to hire until the problem is clearly understood is important for a few key reasons:

Hiring too early can lead to increased payroll without corresponding increases in productivity or revenue. By waiting, a company ensures that every employee contributes significantly to solving well-defined problems, thus optimizing spending and improving cash flow management.

Onboarding new employees can actually slow things down in the short term. Your existing team of high-performing, efficient employees will need to take time away from their work to bring the new hires up to speed. You won’t get increased capacity for months, depending on what your ramp time is like.

Last but not least, understanding the problem deeply helps in identifying the specific skills and expertise required to address it. This clarity allows a company to hire individuals who are the best and right fit for the specific challenges it faces, rather than recruiting a workforce that may not align with your actual needs.

“Resist the knee-jerk temptation to throw staff at a GTM problem, and be willing to explore other solutions. As a capital-efficient growth operator, hiring should be your last resort.”

-George Alifragis, Senior VP at Metropolitan Partners Group

LINK To the 15 GTM Problems

Rule #3. Make EBITDA your bestie.

At many companies, the only executives focused on EBITDA (earnings before interest, taxes, depreciation, and amortization) are the CEO and CFO. The functional heads of sales and marketing should (hopefully) quantify their contribution to ARR and NRR but may not be as comfortable with EBITDA.

But if you’re pursuing capital-efficient growth, EBITDA is a vital metric and should be your financial compass. Every GTM leader today needs P&L fluency to fully understand their role and contribution to achieving it.

An EBITDA focus enables reinvestment for growth and profitability. Leading companies treat cost optimization measures as a way to free up capital and reinvest in growth initiatives, which, according to McKinsey analysis, accounts for over 50% of transformation value.

For example, sales, revenue, and marketing leaders need to understand if they are driving growth in the most profitable verticals.

All verticals likely do not have the same customer acquisition cost (CAC), churn, and lifetime value (LTV). They may require different levels of support.

If you win 100 new customers in a profitable vertical, you’re looking at a really different quarter than if you win 100 new customers in a less profitable vertical.

If you renew, upsell, and expand 50 customers who are in your ICP and have a low cost to serve, you will be more profitable than if you do the exact same thing with customers who are more expensive to serve.

If you don’t pay attention to EBITDA and leave it to the CFO and CEO, then you lose authority and autonomy.

They are going to come to you and tell you that you have to cut spending and headcount, because those are the tools they have in their toolbox.

”If you clearly understand how your department contributes to EBITDA, you are in a much better position to control your own destiny while still keeping the company’s best interests at heart.”

-George Alifragis, Senior VP at Metropolitan Partners Group

Rule #4. Use compensation to drive GTM team alignment.

It’s simple, yet impactful.

If you want your team to be invested in capital-efficient growth, you have to incentivize leaders across all teams on both revenue and efficiency.

Sales leaders will have a higher percentage of variable comp tied to revenue, but they should still have a small part of their comp based on whether the company meets cash flow and profitability goals.

Beyond Sales, all teams across the organization should be measured against cost management and operational efficiency.

Reducing or optimizing expenses to improve profitability and thus generate more cash should be a KPI every team member, at every level, is measured on.

Watch how fast everyone starts to care about cash flow in exec team meetings when their paycheck depends on it!

What gets measured, gets done.

Take the GTM MOVE assessment to see where your team is . . . and isn’t aligned on growth.

Rule #5. Everyone is on the GTM team.

At GTM Partners, we like to say that GTM is broader than just sales and marketing. It should also include RevOps, CS, and product.

In truth, every single person in the company can and should be aligned around three north star metrics: brand, pipeline and revenue.

It’s up to the CEO and functional leaders to communicate to every single team in the company how their jobs relate to brand, pipeline, and revenue.

In a hospital, the surgeons get all the glory for saving lives.

But they can’t do it if they don’t have nurses, custodial staff, billing departments, cafeteria workers, and more.

The hospital falls apart without every single person playing their role, and the surgeon can no longer save lives.

It’s the same with GTM, just hopefully a little less life and death. It takes every person in a company doing their job and doing it well for a company to succeed.

Part of achieving capital-efficient growth is ensuring every team player understands how they pragmatically contribute to overall company goals.

Brand: If you define a brand as not just the creative brand but more as the brand experience, then everyone becomes a brand caretaker and ambassador. HR is communicating the brand by how they interact with potential talent. Developers impact the brand by the kind of experience the product they create provides. The custodial staff maintains the building that may be the very first impression on a potential customer or future employee. The finance and legal teams even play a role in how they negotiate contracts, and that experience can make or break a deal.

Pipeline: Similarly, every team contributes to the pipeline. HR is hiring the marketers and salespeople building the pipeline. Engineers are adding features and functions that make people want to buy. Financial insights help a company allocate resources efficiently to drive pipeline, conversion, and prevent revenue leakage.

Revenue: The finance team manages funds wisely, ensures compliance, provides accurate financial forecasts, and informs decisions that drive revenue. HR and hiring leaders find the best sales people. Engineers ensure that technology is cutting-edge, reliable, and scalable in order to maintain a competitive edge, attract new customers, and retain existing ones.

Challenge your team members to brainstorm and define how they contribute to brand, pipeline, and revenue. That way, when the CEO stands up at a town hall to talk about company goals, everyone truly feels empowered to make a difference.

We are training and certifying thousands of GTM professionals in our GTM Operating System.

In closing . . .

Capital-efficient growth is not just about conserving cash but about maximizing the value, impact, and return of every dollar spent.

Capital is no longer growing on trees.

The era of zero interest rates (ZIRP) may never return.

In its place, we must learn, or relearn, how to achieve and sustain capital efficiency.

Understand how every dollar of outside capital, both equity and debt, is going to generate an additional dollar of profitable revenue and value.

The team’s ability to generate profits from its core operations and maintain strong cash flows allows the company to rely less on outside capital just to keep the lights on.

Instead, keep your own lights on, focus on making critical investments, and leverage outside strategic capital to drive catalytic organic and inorganic growth, all of which contribute to enterprise value creation.

GTM Poll of the Week

For companies that are using outbound, is it working as well? Are you getting the same engagement rates? Is it delivering the same pipeline? Is it contributing the same percentage of closed-won business?

GTM Problem of the Week

Send us your most pressing GTM problem, and you’ll get a short session with an analyst to answer it!

Dear GTM Partners,

I have a leadership question for you. I’m an aspiring CMO that is very good at getting stuff done, leading teams, and implementing wonderful ideas, but I am not the big idea visionary guy. Do I have a future as a CMO? Or are companies looking for the creative thinkers to lead a team of creative people?

Marketing VP in Wisconsin

Dear Marketing VP in Wisconsin,

Succeeding in business takes all kinds of personalities.

We call it the Dreamer-Doer-Driver framework (we wrote all about it here.)

Never assume that this is a hierarchy and that Dreamers are leaders, Drivers are middle management, and Doers are individual contributors.

Any personality type can thrive at any level in a company. All can be leaders, all can be followers.

Dreamers are visionary leaders who excel at inspiring others with their big-picture thinking. They are highly creative and have the ability to envision ambitious long-term goals. Dreamers motivate their teams through their passion for a compelling future vision. However, they may struggle with practical execution and occasionally generate unrealistic ideas.

Doers are action-oriented leaders who prioritize getting things done. They are results-driven and highly organized, ensuring tasks and projects are completed efficiently and on schedule. Doers hold themselves and their teams accountable, but their focus on execution can sometimes limit creativity and flexibility.

Drivers are decisive and competitive leaders who thrive on challenges and achieving measurable outcomes. They are relentless in their pursuit of goals and excel at problem-solving. Drivers push for rapid progress but can be impatient, potentially coming across as forceful. Managing burnout and team morale can be a challenge for them due to their intense focus on results.

It sounds from your very short description that you are a Driver. And there’s a natural instinct to be drawn to other Drivers. You understand each other. You probably think your way is the most effective way.

The real trick is that you need to work closely with dreamers and doers. Just as a dreamer leader would need to make sure to surround themselves with doers and drivers.

That might mean you need to choose a company with a visionary CEO, or you might need to hire a few dreamers to work for you on your marketing team.

It can be helpful in an interview process to get a read on what style your CEO and direct reports are. If you’re joining a company of drivers, you have less to bring to the table, even if it may feel more comfortable to you.

Hope that helps, and that you now feel confident you can absolutely do the job of CMO even if you aren’t a dreamer!

Love,

GTM Partners

GTM News

What we’re reading, watching, listening to, and paying attention to this week.

The Top 4 Content Marketing Trends, from Rev Genius

From the Juice, A Playbook for the New Era of ABM with Demandbase’s CMO, Kelly Hopping

Nice piece from the GTM Newsletter about how startup co-founders met (most met at work or school).

GTM Events

A list of upcoming events of interest to GTM professionals

June 6, Boston: Pavilion CRO Summit

June 7, Boston: GTM Made Simple Roadshow

June 19, Virtual: Death to the Old Inbound and Outbound Playbooks - How to Fix Your Pipeline

July 9-11, London: GTM EMEA from Pavilion

September 18-20, Boston: INBOUND 2024

Take our GTM assessment with your team to see how you can evolve and where you’re misaligned.

Excited to share an announcement soon about a big upcoming project and event series we have planned. We will also be in Boston in June, hope to see you there!

Love,

The GTM Partners Team